Yinglian Co.'s Net Profit Soars 1573%: The Story Behind the 'High-Stakes' Shift from Metal Packaging to New Energy

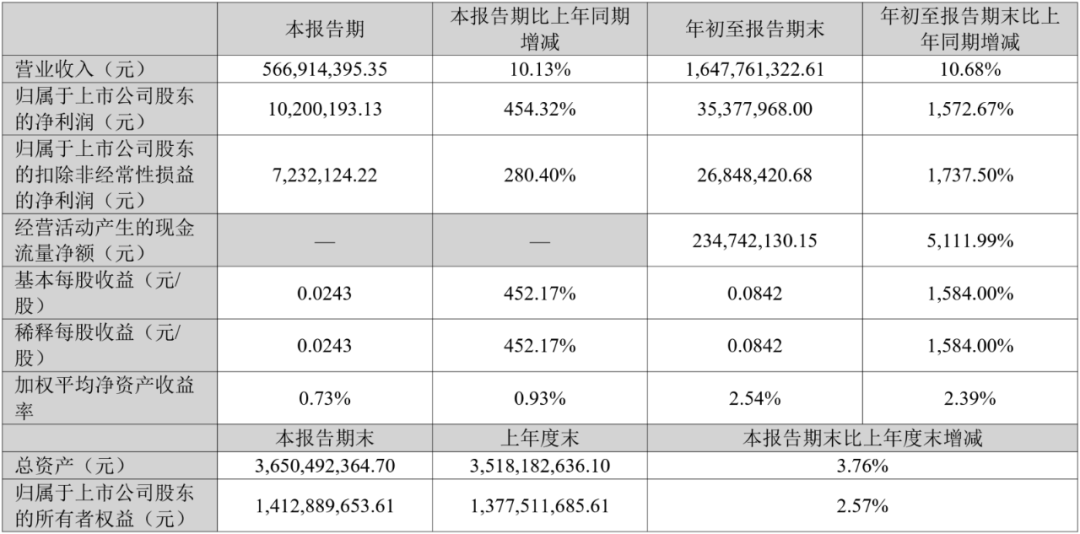

Yinglian Co., Ltd. (002846) recently disclosed its Q3 2025 report, showing that the company achieved operating revenue of 1.648 billion yuan in the first three quarters, up 10.68% year-on-year; net profit attributable to shareholders was 35.378 million yuan, a staggering increase of 1572.67% year-on-year, successfully turning losses into gains. Net cash flow from operating activities was 235 million yuan, soaring 5112% year-on-year, which on the surface appears to be a "remarkable turnaround."

However, if you analyze the profit structure, the sustainability of this high growth is still worth guarding. The company's gross profit margin was only 12.56%, an increase of 1.81 percentage points over the previous year, but still lower than the average level of most peers (such as about 15%-18% for Orijin and Jihong shares); The net profit margin is only 2.0%, indicating that the main business is still dominated by low-profit competition.

During the period, expenses reached 169 million yuan, an increase of 22.5 million yuan year-on-year, of which sales expenses increased by 29.21% and R&D expenses increased by 24%, indicating that the company still needs to maintain the growth momentum with high investment despite limited revenue growth. If revenue growth slows down, this expense structure will become a new profit burden.

Cross-border new energy: a high-investment risk game

During the reporting period, the company focused its strategic focus on the field of new energy materials, planning to invest 3.089 billion yuan to build a composite current collector project, including an annual production capacity of 100 million square meters of composite aluminum foil and 500 million square meters of composite copper foil. At present, only 5 composite aluminum foil and 5 copper foil production lines have been built, and the products are still in the testing stage of power battery customers.

The composite current collector is a key component of lithium batteries, which has both lightweight and safety advantages, and is regarded as a new generation of materials by leaders such as CATL and BYD. However, this field has a high technical threshold, a long verification cycle, and a longer payback cycle. Based on the existing planned investment scale, 3.089 billion yuan is almost equivalent to 1.5 times the operating income of Yinglian shares in 2024 and 85% of the company's total assets. In the absence of both core patents and industry voice, this "gamble-style" cross-border will bring heavy capital and execution pressure.

More importantly, the current competition in the domestic lithium battery copper foil market is fierce. In 2025, the national lithium battery copper foil production capacity is expected to exceed 16 billion square meters, and the capacity utilization rate is less than 70%. The leading enterprises Putailai, Jiayuan Technology, Nord shares, etc. have obvious advantages in customer certification and scale cost, and if Yinglian shares are difficult to quickly achieve mass production of products, they will face the dilemma of "entering the market".

The main packaging business expanded, but the market ceiling was approaching

In addition to the new energy project, the company also invested 918 million yuan to build a can easy-to-open lid manufacturing base, which officially started on October 13, and plans to improve production capacity and process level through intelligent production lines. Yinglian is one of the important players in the domestic easy-to-open lid industry, with customers covering the fields of food, beverage and chemical cans.

However, from the perspective of industry trends, metal packaging has entered the stage of stock competition. According to data from the China Business Industry Research Institute, the domestic metal easy-to-open lid market size will be about 35 billion yuan in 2024, with an annual growth rate of less than 3%. At the same time, environmental protection constraints are becoming stricter, aluminum prices fluctuate frequently, and the substitution trend of degradable plastics and paper-based packaging is accelerating. Although the traditional main business of Yinglian shares is still stable, it is difficult to support high growth. Continuing to expand production in an environment of limited demand growth may lead to a decrease in capacity utilization and a delay in return on investment.

Frequent capital operation and high dependence on financing

In the face of huge investment, the company chose to raise funds through the capital market. In September 2025, the company's board of directors deliberated and approved the plan to issue A-shares to specific targets, intending to raise no more than 1.5 billion yuan, and the funds will be mainly used for composite current collector projects and easy-to-open cover projects. At the same time, its wholly-owned subsidiary Shantou Yinglian introduced the Guangdong Guangdong Property Industry Technology Equity Investment Fund, with the first batch of 45 million yuan and a maximum shareholding of 15.63% in the future.

But behind these capital actions is the continued tight cash flow pressure of enterprises. At the end of the third quarter, the company's asset-liability ratio was 59.8%, an increase of nearly 8 percentage points compared with 2023. The significant increase in operating cash flow mainly comes from the improvement of the payment cycle, rather than the substantial increase in main profit. If the private placement is blocked or the return of the project is delayed, Yinglian shares may face the dual risks of tight cash flow and debt expansion.

Management challenges under family governance

The governance structure of Yinglian shares still shows obvious family characteristics. The actual controller, Weng Weiwu, holds 40.89% of the shares, forming a concerted action relationship with general manager Weng Baojia and other family members. Weng Baojia's salary in 2024 will be 1.11 million yuan, and Chairman Weng Weiwu will be 780,000 yuan, and the two will control a number of subsidiaries at the same time. Family management is good for stabilizing control, but it can also weaken internal checks and balances and transparency.

In addition, the company has more than 700 "Sky Eye risks" in its own and surrounding areas, most of which are general business warnings, but reflect its potential risks in financial, contractual and litigation management. In the face of billions of yuan investment plans, the standardization of governance mechanisms is particularly critical.

The external environment is tightening, and the transformation window is limited

From a macro perspective, Yinglian Co., Ltd.'s 'new energy dream' is currently in a phase of rational adjustment following a peak in the cycle. According to GGII data, the growth rate of China's installed capacity for power batteries is expected to drop to 18% in 2025, far below 48% in 2023. Industry capital expenditures are generally contracting, and approval for new projects is becoming stricter. In this environment, if Yinglian Co., Ltd.'s composite current collector project cannot quickly achieve mass production and secure clients, it will face the difficult situation of high investment but slow returns.

At the same time, the metal packaging business is under dual pressure from declining international orders and rising costs. In the first half of 2025, China's metal packaging exports fell by 8.4% year-on-year, forcing some small and medium-sized enterprises to cut production. While Yinglian Co., Ltd.'s traditional market remains relatively stable, the room for growth is limited.

Conclusion: Behind the surge in profits lies a high-risk cross-sector gamble.

Yinglian Co., Ltd.'s explosive performance in the first three quarters of 2025 appears more like a structural rebound rather than a qualitative change in profitability. The high-investment, high-risk layout in new energy, combined with weak growth in traditional businesses, places this manufacturing company with a market value of tens of billions at a strategic transition crossroads.

From metal packaging to new energy materials, Yinglian Co., Ltd.'s path is ambitious but fraught with uncertainty. Whether the current high growth can be sustained depends not only on the progress of project production but also on its ability to implement technology, manage finances, and govern effectively. In the coming years, the company may repeatedly weigh 'innovation' against 'stability,' and this cross-sector gamble is far from reaching a decisive outcome.