International Paper, with an annual revenue of 164.1 billion, splits into two, and two new listed giants emerge on the scene!

Against the backdrop of global manufacturing fluctuations and supply chain restructuring, the global leader in the paper industry-International Paper-dropped a bombshell during a recent earnings call. CEO Andy Silvernail officially announced that the company will split its existing business footprint into two independent publicly traded companies, following a geographic logic.

This decision not only signifies that this century-old industrial giant is undergoing a profound self-transformation, but also marks a new stage of strategic contraction and precise focus, following its completion of the acquisition of the UK packaging giant DS Smith.

Strategic Simplification: From "Joining Forces" to "Dividing Territories"

About a year ago, International Paper completed a bold cross-border acquisition of London-based DS Smith, which was seen as a key step in building a global packaging empire. However, just a year later, the company's strategic focus has shifted dramatically. According to the latest spin-off plan, International Paper will retain its core North American business while spinning off its Europe, Middle East, and Africa (EMEA) operations.

Silvernale candidly admitted during the conference call that the move indeed came as a surprise to most investors, but he emphasized that the spin-off is intended to better unlock the potential of each business. After the spin-off, the existing EMEA operations will operate as an independent company, with plans for dual listings on the London Stock Exchange and the New York Stock Exchange. Despite the impending spin-off, International Paper still intends to retain a considerable stake in the new company to maintain a certain level of strategic synergy.

To ensure that the "new entity" can gain a strong footing after the spin-off, International Paper has shown great commitment: the company plans to invest about $400 million in the EMEA region this year for technology upgrades and operational optimization. This complex "separation" is expected to be fully completed within the next 12 to 15 months.

Silvernale stated that, although this is an extremely challenging task from the perspectives of accounting standards and asset liquidation, the company will spare no effort to accelerate its progress.

Performance Pressure and Growing Pains: Cold Reflection Behind the $2.8 Billion Loss

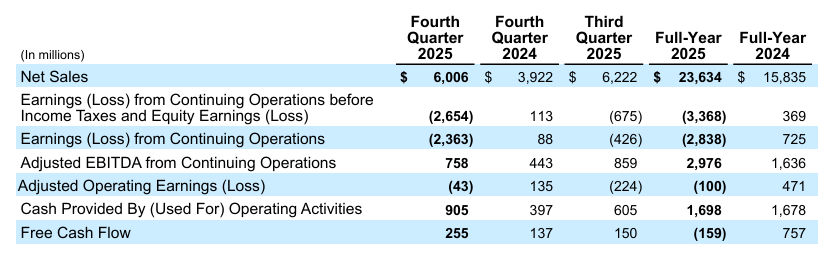

Behind this spin-off plan lies the severe operational pressure faced by International Paper. According to the financial report released on Thursday, the company's annual performance for 2025 is not optimistic. Annual net sales totaled $23.63 billion (approximately RMB 164.1 billion), but the net loss reached $2.84 billion (approximately RMB 19.7 billion).

Of this, North American operations contributed $15.2 billion in sales, while EMEA operations generated $8.5 billion. Despite facing headwinds from the global economy, the company managed to achieve about $510 million in gains through cost improvement initiatives, but this clearly was not enough to offset the massive impact of the macro environment.

Currently, market demand in EMEA continues to be weak, and signs of recovery lag significantly behind the North American market. Due to the varying degrees of challenges faced by each business segment, International Paper had to take more aggressive "slimming" measures.

Since October 2024, the company has set off a wave of factory closures and layoffs around the world. According to CFO Lance Loeffler, the company has closed 20 factories in EMEA and cut 1,400 jobs in 2025, and many factories in North America have not been spared.

However, this is not the end. The company plans to further streamline its organization this year, closing seven more factories in EMEA and eliminating at least 700 jobs.

Silvernell pointed out that these actions are different in nature from previous large-scale layoffs and are more based on a "microscopic" look at supply chain and procurement details. In the current competitive environment, cost control must be precise to every penny in order to survive in a small profit margin.

The "80/20" Code: The continuation and implementation of the driving force of transformation

Although the structure is changing, the core business logic of International Paper has not wavered. Since taking office in May 2024, Silverell has vigorously promoted his proud "80/20 Efficiency Plan". The core of this plan is to focus 80% of the energy on 20% of core high-quality businesses and customers, and optimize the overall business layout by cutting redundancy costs.

Currently, International Paper has implemented the so-called "lighthouse model" (regional hub strategy) in 85% of its carton mill systems. This model improves the efficiency of resource allocation between factories by establishing regional core centers. Loeffler said that as the experience of the "lighthouse model" is extended to all plants around the world, the company's operational reliability has begun to improve significantly.

In response to analysts' questions about whether the weakness in the European market forced the company to split, Silverell gave a firm negative answer. He believes that the spin-off is based on a deep understanding of the value creation prospects of the two regional markets.

The merger of Desma and International Paper has demonstrated the synergy between the two companies in terms of cost reduction, but it also exposes the huge differences in business strategies and competitive environments between the two regions. By creating independent companies, management can leverage tailored business strategies, separate balance sheets, and more flexible capital allocation to capture unique and attractive opportunities in their respective markets.

With the spin-off of the business, the leadership of International Paper also ushered in a new layout. Andy Silverell will continue to take charge of International Paper as CEO, while CFO Lance Loeffler and Head of North American Packaging Solutions Tom Hammick will remain in their roles to solidify their dominance in the North American market.

The newly formed EMEA packaging company will be led by veteran Tim Nichols. Nichols, who has previously been appointed head of Desma's business, is confident in this transitional period. He said that although it is still in the early stages of optimizing business layout and reducing structural costs, the new company will show strong organic growth and epitaxial M&A capabilities as various initiatives come to fruition in 2026.

Looking Ahead: Finding Certainty in the Storm

Standing at the starting point of 2026, the prospects of the international paper industry show a trend of "first suppressing and then rising". Despite a strong start to market demand in January, executives remain cautious about the full-year trend, expecting demand to gradually slow over time. The company forecasts that the overall sales of the business in 2026 will fall between $24.1 billion and $24.9 billion, and free cash flow is expected to be between $300 million and $500 million.

In addition to macroeconomic pressures, the company also has to face some unforeseen unexpected costs. For example, recent winter storms caused about $25 million in losses in the first quarter; In addition, the company also needs to invest $80 million to renovate the production line at the Riverdale, Alabama, from producing offset paper to containerboard, which is in greater market demand.

However, Loeffler has high hopes for performance in the second half of the year, and he expects performance to accelerate significantly in the second half of the year as the restructuring effect emerges and market strategies are adjusted. A series of changes in the international paper industry - from cross-border acquisitions to strategic spin-offs, from drastic factory closures to refined cost control - all demonstrate the survival and enterprising spirit of an established industrial giant in the face of the upheaval of the times. Whether this "split in two" gamble will allow the two new companies to reshape their glory on their respective battlefields, the global packaging industry is waiting to see.