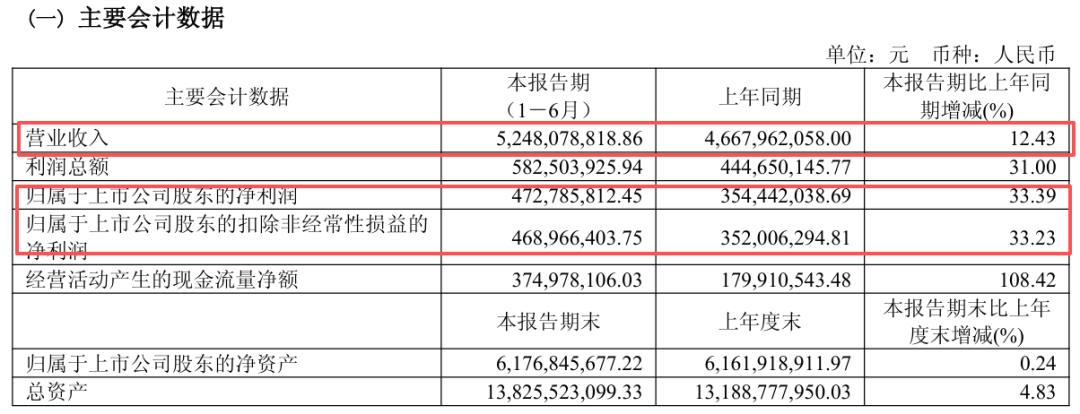

Revenue of 5.2 billion and net profit of 470 million both hit a new high, and Zijiang Enterprise's half year performance report is dazzling!

Recently, Shanghai Zijiang Enterprise Group Co., Ltd. released its semi annual report for 2025. The report points out that Zijiang enterprises have demonstrated strong operational resilience and development potential in a complex macroeconomic environment. During the reporting period, the company achieved a total operating revenue of 5.248 billion yuan, a year-on-year increase of 12.43%. More noteworthy is that the company's profitability has significantly improved, with a net profit attributable to shareholders of the listed company reaching 473 million yuan, a significant increase of 33.39% compared to the same period last year. After deducting non recurring gains and losses, the net profit also achieved a growth of 33.23%.

The net cash flow generated from operating activities was 375 million yuan, a year-on-year increase of 108.42%, mainly due to the reduction of various tax payments. From the perspective of financial indicators, the basic earnings per share were 0.312 yuan/share, a year-on-year increase of 33.33%. The weighted average return on equity also increased from 6.02% in the same period last year to 7.48%, reflecting the effective utilization of the company's assets and the significant enhancement of shareholder return ability.

Review and Analysis of Core Business Segment Operations

Zijiang Enterprises has formed an industrial layout with packaging business as the core, supplemented by commercial, real estate, and venture capital businesses. During the reporting period, the company promoted the steady development of various business segments by focusing on innovation and green transformation, deepening customer cooperation, improving production efficiency, and optimizing cost control measures. In the first half of 2025, the revenue of beverage packaging business will be 2.514 billion yuan; The revenue from paper plastic packaging business was 1.486 billion yuan, the revenue from aluminum-plastic film business was 324 million yuan, the revenue from real estate was 360 million yuan, and the revenue from other businesses was 389 million yuan.

01

Beverage packaging business: Continuously strengthen cooperation with major customers, and launch new projects

Beverage packaging is the core business of the company, covering products such as PET bottles, preforms, crown caps, plastic anti-theft caps, labels, and OEM filling. In the first half of the year, the company continued to strengthen cooperation with strategic customers, closely followed customer layout, and actively developed new customers, achieving stable growth in sales revenue and profits.

Container Packaging Division: Multiple new production line projects, in collaboration with clients such as Chongqing Blue Moon, Changsha Dongpeng, Meishan Qianhe, etc., have been put into operation on schedule. Meanwhile, projects such as Zhengzhou Cola, Xi'an Cola, and Tianjin Dongpeng are also under construction. The company has continuously invested in environmental protection, lightweight, automation, and intelligent research and development, completed the industrialization of 35g lightweight bottle preforms, and implemented automation projects such as AGV automatic logistics systems.

Beverage OEM Division: The newly added sterile lines in Guangdong, Sichuan, and Shaanxi have been officially put into operation, and deep cooperation with emerging brand companies has led to a 62% year-on-year increase in business volume for non strategic customers.

Ziri Packaging and Ziquan Label: Ziri Packaging's business scale continues to expand, and the Vietnamese factory has been successfully put into operation, completing the installation and commissioning of the first dual channel bottle cap coding laser equipment in China. Ziquan Label has been ranked fifth in the "Top 50 Brands with Influential Influence in the Label Printing Industry in 2025" and has successfully achieved mass production of the pull tab cover project.

02

Soft package business: focusing on high-end and cutting-edge fields, diversified development

The soft packaging business includes color paper packaging printing, lithium battery aluminum-plastic film, spray aluminum paper and cardboard, BOPA film, etc., widely used in fields such as food, medicine, daily chemical, electronic technology, etc.

Zijiang New Materials: While consolidating its market share in the mid to low end of aluminum-plastic film, it focuses on differentiated products and enhances its market share in high-end consumer electronics and new energy vehicle power batteries, achieving synchronous growth in sales revenue and profits. At the same time, the company is continuously advancing its technological reserves in cutting-edge application fields such as semi-solid and solid-state batteries.

Paper Packaging and Zijiang Color Printing: The Paper Packaging Division has made significant progress in cooperation with clients such as Hua Lai Shi and Tastin. Zijiang Color Printing has passed the carbon management system certification, and the two projects invested in, Anhui Zijiang Medical and Anhui Zijiang Film, have also completed factory construction and equipment installation.

Ziyan Alloy and Zihua Enterprise: Ziyan Alloy has achieved rapid growth in medical, transportation and other sectors. Zihua Enterprise has increased its production capacity through equipment customization and successfully developed new products such as ultra light breathable bottom films.

03

Other businesses: Trade model transformation and steady progress of real estate projects

Zijiang International Trade: Actively promote the transformation of business models, shifting from service agency to enhancing trade value.

Real estate business: The last 14 villas of Zidu Shanghai Jingyuan Phase III North District have been successfully delivered and revenue has been confirmed. The new "Sheshan Purple Moon Peach Garden" project also started construction in May, with plans to build 128 Chinese style compound courtyards.

From the perspective of its subsidiaries, Shanghai Ziquan Packaging Co., Ltd. ranked first with a revenue of 777 million yuan, demonstrating outstanding performance and far surpassing other subsidiaries. Next is Shanghai Ziquan Label Co., Ltd., with a revenue of 428 million yuan. The revenue of Shanghai Zidu Sheshan Real Estate Co., Ltd., Shanghai Ziri Packaging Co., Ltd., Shanghai Zijiang New Material Technology Co., Ltd., and Shanghai Zidan Video Packaging Printing Co., Ltd. all exceeded 300 million yuan. The two companies with the lowest revenue are Shanghai Zijiang International Trade Co., Ltd. (171 million yuan) and Shanghai Zijiang Enterprise Investment Co., Ltd. (21.7217 million yuan). This may reflect their business nature (such as trade or investment), and their revenue scale is usually small.

In terms of net profit, Shanghai Zidu Sheshan Real Estate Co., Ltd. had the highest net profit, reaching 67.8835 million yuan, indicating a high profit margin in its real estate business. The net profits of Shanghai Ziri Packaging Co., Ltd. and Shanghai Ziquan Packaging Co., Ltd. are also relatively high, with 59.1975 million yuan and 46.9086 million yuan respectively. It is worth noting that although Shanghai Zijiang Enterprise Investment Co., Ltd. has the lowest revenue, its net profit reached 38.9207 million yuan, which may come from its non core business income such as investment income or asset disposal, reflecting the high return rate of its investment business. The net profit of Shanghai Zijiangdan Food Packaging Printing Co., Ltd. is 4.4432 million yuan, which is relatively low compared to its revenue of over 300 million yuan.

In addition, the company mainly holds stakes in Shanghai Sunshine Hotel Co., Ltd., Wuhan Zijiang Unified Enterprise Co., Ltd., Zhengzhou Zitai Packaging Co., Ltd., and Hangzhou Zitai Packaging Co., Ltd iXingPackagingIndustryPLC, Suzhou Zixin Packaging Materials Co., Ltd. and other participating subsidiaries contributed investment income of 8.0607 million yuan to the company.

Exploration of Core Competitiveness and Future Prospects

Zijiang Enterprises have a solid core competitiveness in management, technology, talent, and values. In terms of management, the company has accumulated rich experience through long-term cooperation with well-known domestic and foreign enterprises; Technologically, refined management and continuous technological upgrades have brought cost advantages; In terms of talent, an efficient management team and professional R&D personnel provide guarantees for the company's development; In terms of values, the concept of "focus, simplicity, persistence, and persistence" has become the internal driving force for the company's progress.

Despite facing risks such as economic fluctuations, changes in raw material prices, and seasonal impacts in the food and beverage industry, the company has formulated corresponding countermeasures. By transforming marketing concepts, utilizing centralized procurement to reduce costs, optimizing product structure to reduce dependence on a single industry, and conducting sufficient research and demonstration before new product development, the company is expected to continue to enhance its risk resistance capabilities.

Overall, the significant growth in revenue and net profit achieved by Zijiang Enterprises in the first half of 2025 not only reflects the strong momentum of its main business, but also benefits from its forward-looking strategic layout and lean operational management. While maintaining a leading position in traditional packaging business, the company continues to make efforts in new materials, intelligence, and green transformation, injecting new momentum into future development.

Especially, the company's layout in high-end new materials such as lithium battery aluminum-plastic film, as well as its continuous investment in automation and intelligence, indicate its transformation from a traditional manufacturing enterprise to a high-tech, high value-added innovative enterprise. At the same time, actively responding to the action of "improving quality, increasing efficiency, and emphasizing returns", and continuing to distribute cash dividends, also demonstrates the company's high attention and confidence in investors.

Looking ahead to the future, Zijiang Enterprises will continue to focus on packaging and new materials, continuously enhancing their core competitiveness through technological innovation and market expansion. Although external environmental challenges still exist, with its diversified business structure, strong customer base, and sustained innovation capabilities, Zijiang Enterprises is expected to maintain a leading position in fierce market competition and achieve sustainable high-quality development.