The packaging and printing industry is undergoing a major reshuffle, with bankruptcy applications and non bankruptcy shutdowns reaching a new high in nearly 13 years!

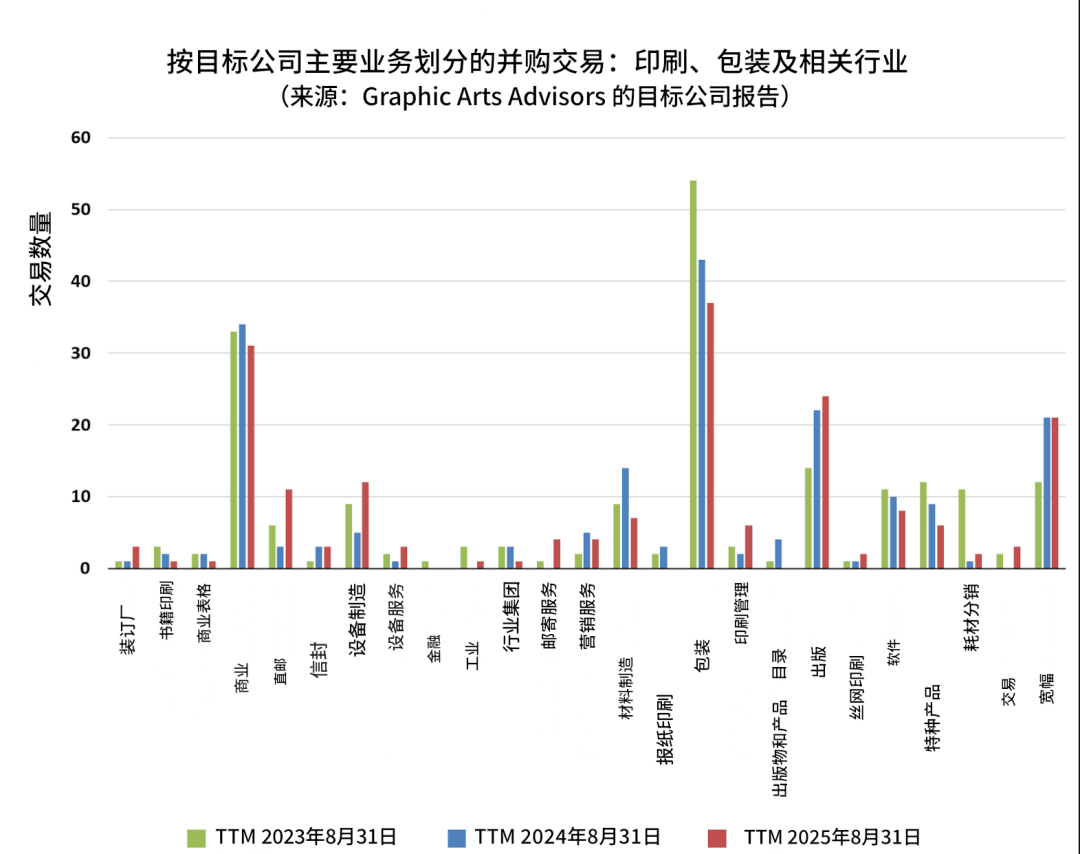

For the past fourteen years, GAA (Graphic Arts Consulting) has continuously recorded and commented on mergers and acquisitions across multiple business lines centered around the packaging and printing industry, with a focus on commercial printing, packaging (labels, folding paper boxes, flexible packaging), and large format printing markets. Every August, we review the transaction characteristics of the past 12 months to determine the future direction of the industry: which segments of mergers and acquisitions are increasing or decreasing? How has the dominant logic of the buyer completing the acquisition changed? Is it expanding the network or integrating? What insights do they provide for potential trading activities in future segments?

The overall conclusion for this year is that the number of mergers and acquisitions has remained stable but visibility has decreased. Although the overall performance of the US economy has been robust in the past year (with moderate interest rate hikes to curb inflation), signs of an "uneven track" have increased around the fall of 2024- bankruptcy filings and non bankruptcy closures are on the rise, and weakened demand has become a high-frequency term in the mouths of business owners. The significant increase in consultation volume for GAA's "special circumstances" business in recent months indirectly confirms the trend of business pressure spreading.

At the rhythm level, a three-month rolling observation of trading announcements within the year shows that it peaked in January and bottomed out in July August; From the year to the present, overall trading activity remains stable. In terms of transaction volume and distribution, the industry has recorded a total of 191 noteworthy M&A transactions in the past 12 months. Compared to the previous statistical cycle, it only slightly increased by 1.1%, still lower than the high point of 12.4% in 2022. Since the release of the annual review in 2016, the current absolute trading volume is close to a low level.

01

Commercial printing: The proportion of mergers and acquisitions is increasing, and external new capital is cautious

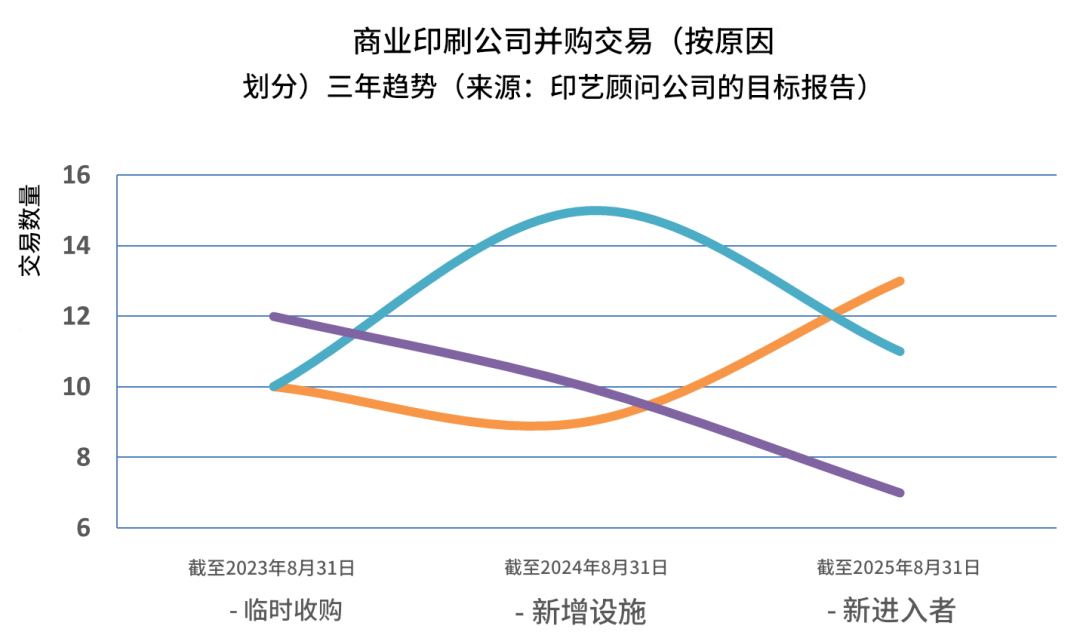

The overall transaction volume of commercial printing is stable, but if the structure is broken down, it can be seen that the pressure signal is strengthening: the proportion of mergers and acquisitions has risen to 42% (31.3% in 2023; 26.5% in 2024), significantly increasing. Merger based acquisitions typically relocate the seller's customers to the buyer's production line, where the buyer does not assume trade or other debts and selectively receives necessary or ideal equipment. An increase in proportion often indicates overcapacity and intensified financial pressure, as well as a decrease in buyers willing to take on factory consolidation operations, or sellers who have experienced long-term operating losses.

The acquisition of whole plants to maintain operations has decreased. In the past year, there were a total of 18 cases of "maintaining original factory operations after acquisition" in commercial printing, of which 11 were due to buyers adding branches/production lines, and 7 were completed by new entrants. It is worth noting that among the 7 new entrants, 6 acquired small franchise stores, and the 7th acquired a commercial printing enterprise that also operates photocopying. After excluding the smallest storefronts, commercial printing did not attract new external investors.

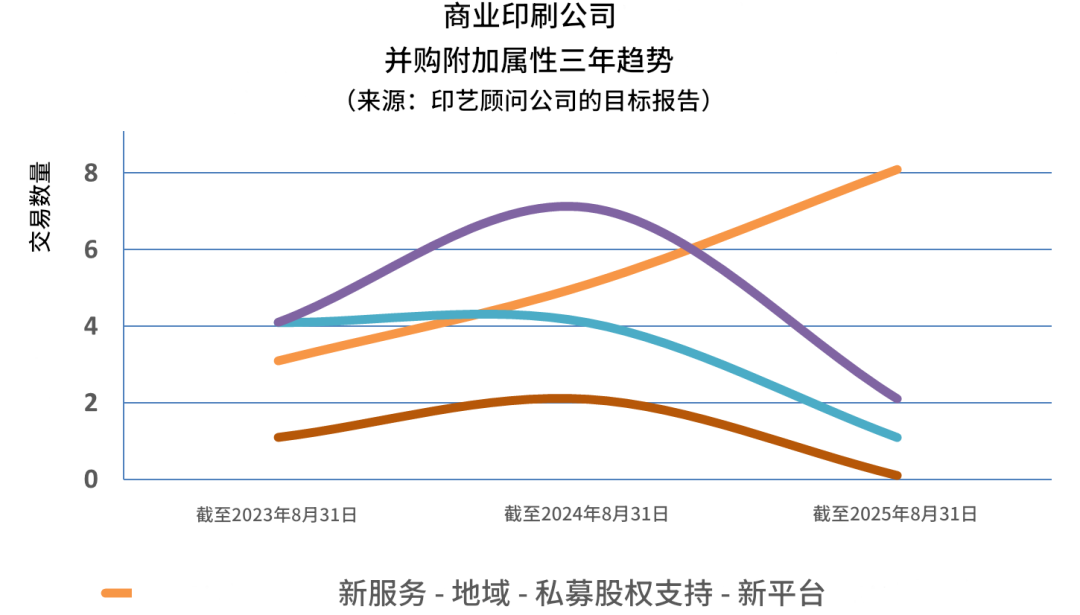

In terms of buyer motivation and industry integration, among various factors such as "regional expansion", "new services", and "private equity participation", new services are the most commonly mentioned transaction motivation: mail service companies enter commercial printing through acquisitions (typical horizontal integration). Professional magazine publishers acquire commercial printing companies. A commercial printing company was acquired due to its emerging folding paper box business.

Many homeowners recall that their performance in 2022 was "outstanding", and some companies remained strong in 2023, but weakened from 2023 to 2024, making 2025 even more "challenging" to date. Complaints about labor shortages have significantly decreased, but skilled operators of simulation machines are still difficult to find. The issues related to paper supply have basically disappeared, and the high inventory in the early stage has been digested. The pricing power overall 'returns to the buyer'. The interest of private equity in commercial printing has significantly cooled down, with no new private equity supported platform projects announced in the past year. Although it has not returned to the "capital cold period" before COVID-19, caution has been the consensus.

Representative transactions include Drummond (headquartered in Jacksonville, Florida) acquiring Tucker Casbury Printing Company in Atlanta and New London Communications to strengthen its influence in the southeastern region through a dual site layout. This is a typical example of regional integration strategy (rather than national integration), which involves steadily strengthening in selected urban areas through operational acquisitions and mergers and acquisitions.

02

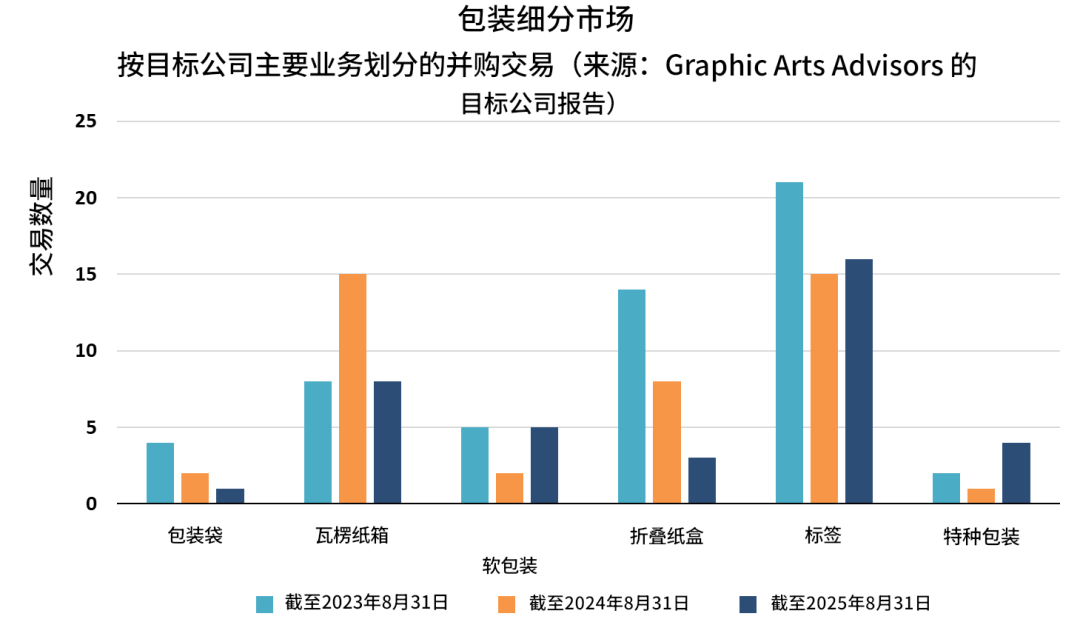

Packaging industry: still the most active, but its popularity has declined; Tag cooling, stable proportion of private equity

The packaging market has been the most active segment for five consecutive years, but the number of public transactions has decreased in the past two years. Label printing remains stable but has significantly cooled down, with only 16 transactions in the past 12 months, compared to 29 transactions in 2021 and 41 transactions in 2022 (driven by private equity at that time). The purchase quantity of corrugated packaging and folding paper boxes has decreased compared to last year.

From the perspective of transaction structure and motives, of the 37 packaging transactions recorded in the past 12 months, only 1 was a merger style acquisition (buyer Meyers merged an old folding cardboard box factory into a nearby existing factory; the buyer also made a similar merger last year). Most buyers emphasize that adding new production capacity/facilities and expanding geographical coverage are key drivers for the acquisition. Private equity participated in 19 transactions, accounting for 51%, unchanged from the previous year. Seven new entrants entered the market, with three of them building a brand new platform. The importance of regional expansion as the core driving force has decreased compared to previous years.

In terms of influence, the series of actions taken by International Paper to acquire Desma are considered to have a huge impact. After the intervention of International Paper in the deal reached by Mengdi Desma, the European Commission has requested that International Paper sell five European factories to the German Parm Group. Subsequently, International Paper announced the closure of 18 factories in the United States to reshape its global positioning in the packaging substrate market. Most of the closures disclosed in the past year are related to the Desma system (cardboard, corrugated cardboard/cartons).

From the perspective of health, the overall packaging shows a negative correlation of "more transactions and fewer closures", indicating that under the background of continuous integration, the seller environment is still healthy and the valuation is relatively firm.

03

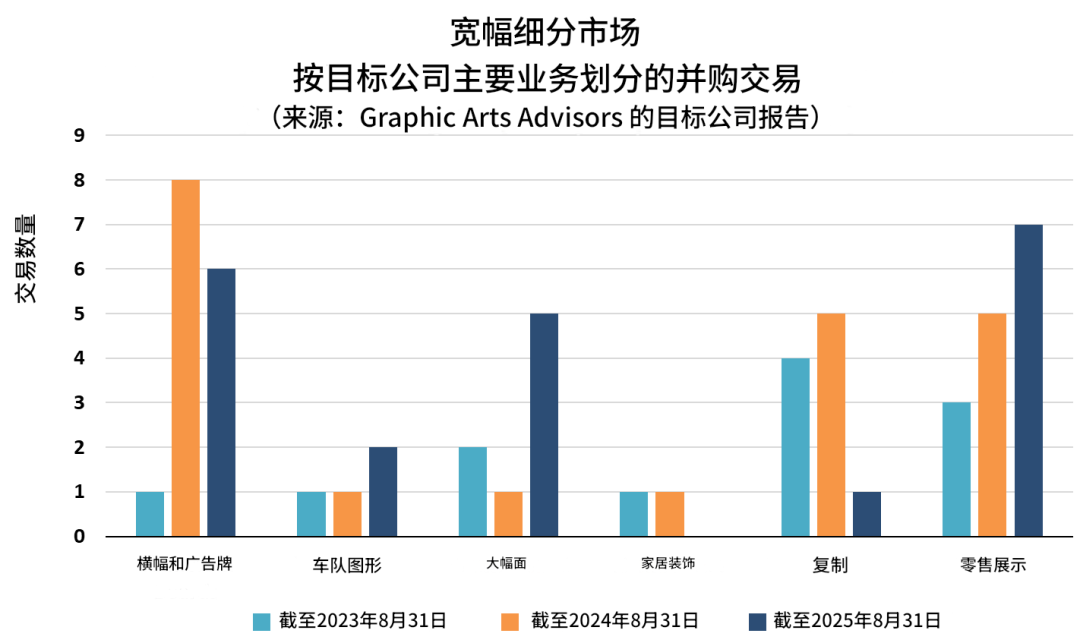

Large format and related digital products: mature and stable, and the rise of experiential graphics

To depict the differentiation of large-scale industries, they are subdivided into retail displays (mainly commercial exhibitions and exhibition equipment), large-scale graphics (event, architectural, experiential graphics), fleet graphics (transportation vehicle body film, etc.), banners and display boards (general large-scale output services).

Firstly, differentiation is shifting from a "first mover advantage" to "online direct sales capability, planning and installation capability, and value-added applications (such as home/office decoration canvas printing)". Secondly, experiential graphics are accelerating their rise as an emerging category. Based on high-quality graphic production, they are overlaid with structural components, audio-visual elements, and diverse interactions to create immersive brand/entertainment experiences.

In terms of trading trends, there have been a total of 21 public transactions on a large scale in the past 12 months, which is the same as last year. Private equity is more active, but no new platforms have emerged. It is expected that future trading activity will continue: those lacking differentiation will be under pressure to exit, while leaders in event/retail/construction/experiential tracks will be more favored by financial investors with high-quality business models.

Representative transactions include Riverside's acquisition of Womela (2024/01); Wasserman acquires Blue Media (March 2024; headquartered in Arizona, specializing in large format printing, installation, and scene based brand building). Moss' acquisition of UK Rocket Graphics (2024/02) is the most representative manifestation of the trend towards "experiential graphics". Moss (headquartered in Franklin, Illinois) specializes in tension fabric graphic installations, with revenue exceeding $100 million. Through continuous mergers and acquisitions, it has expanded its geographic scope and application boundaries, but has always focused on the tension fabric niche.

04

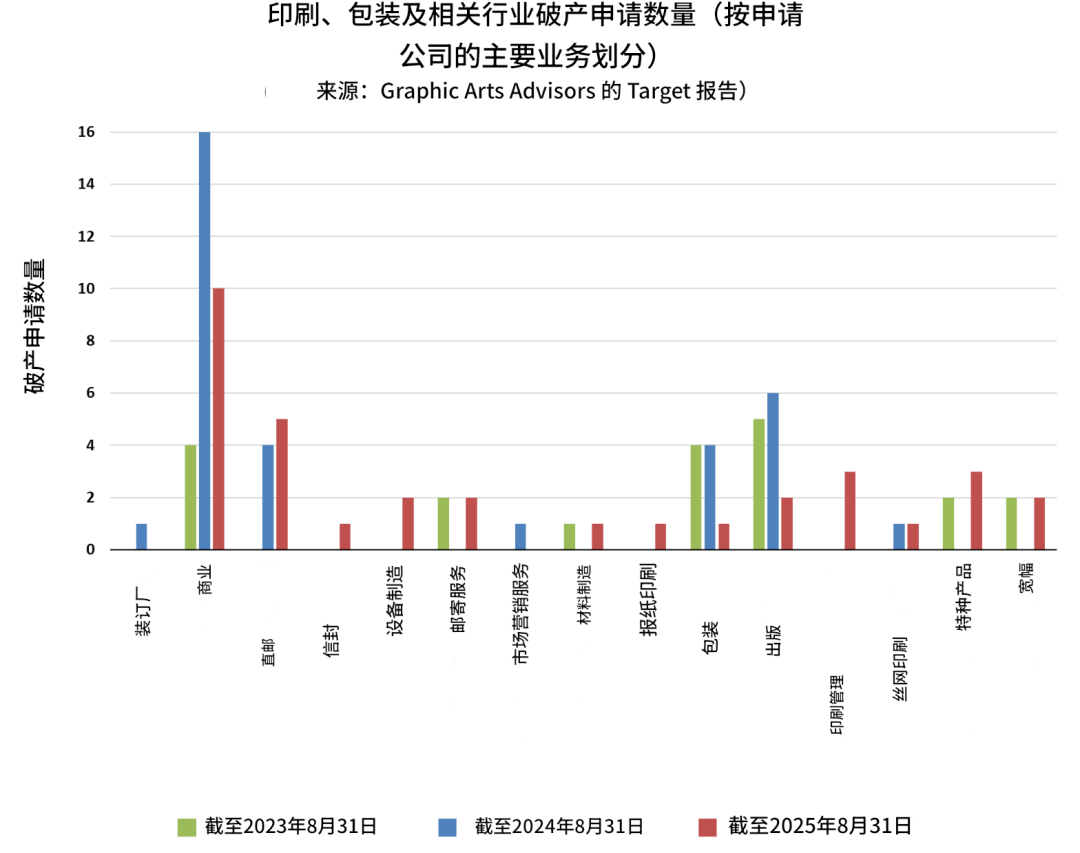

Risk and Warning: Dual Signals of Bankruptcy and Closure

From the perspective of bankruptcy applications, the number has moderately increased, with more small and micro entities. The moderate upward trend that emerged last year continues this year. Upon closer examination of the data, it can be seen that many small businesses are applying for Chapter 7 (Liquidation) bankruptcy, and some owners are not aware of alternative paths. In this industry, unless it is a large enterprise with sufficient size to withstand bankruptcy costs and customer concerns (such as LSC Communications), bankruptcy proceedings are difficult to proceed. The more feasible and prioritized path is to quickly sell the asset/customer portfolio and implement non bankruptcy closure.

Commercial printing once again ranks first in bankruptcy numbers; Five of them come from direct mail. But the most anticipated bankruptcy of the year is undoubtedly Landa Digital Printing Company. The company has installed over 50 units globally, with each unit costing approximately $3.5 million, and has filed for bankruptcy after consuming over $1.3 billion in cumulative investment. For installed users, finding buyers to take over and ensuring continuous supply is the top priority. The latest announcement shows that the sale transaction has been completed.

In addition, non bankruptcy closures have reached a new high since 2012, mainly due to the restructuring of the paper industry. In the past 12 months, there have been 61 non bankruptcy factory closures, a significant increase from the previous year's 41, the highest since 2012 (the previous peak was 57 closures in the 12 months ending on August 31, 2014).

Looking at it in detail, the overall situation is not bleak, mainly due to the structural restructuring of the paper industry: the closure of paper mills has led to the chain withdrawal of related carton factories, especially the streamlining of production capacity in the United States by the international paper industry, which has accelerated this trend. The production capacity of newspaper printing and related roll offset printing advertising inserts continues to shrink. The closure of commercial binding factories has resulted in a high number of closures, possibly due to weakened demand for commercial printing, and large customers relocating binding to improve efficiency and cost competitiveness. It is not surprising that the relevant newspaper printing factories have closed in sync with the suspension of local community newspapers.

In the "new normal", the integration is refined, and finally, the questions of "the best time to go public" and "when the buyer completes the transaction" are answered. Historical patterns show that transactions tend to decline in the summer stage. This year is no exception: although the overall stability has been stable since the beginning of the year, the three-month rolling caliber shows a steady decline after the peak in January, reaching a low point for the year in July and August.

The post pandemic demand boom has ended, the marginal effects of government stimulus have faded, financing interest rates remain high, price discipline has returned, and trade policy uncertainty still exists. Owners' adaptability to the 'new normal' has improved, but optimism and caution coexist. If we extrapolate from the current conversation to next year: more sellers may enter the market; The buyer will have more comprehensive and thoughtful merger and acquisition options; The availability of promotions/discounts (such as terms discounts, instrumental incentives) may increase, facilitating the completion of transactions.