Losses surge by 60%, cardboard packaging giant Jifeng's semi annual report reveals cold winter

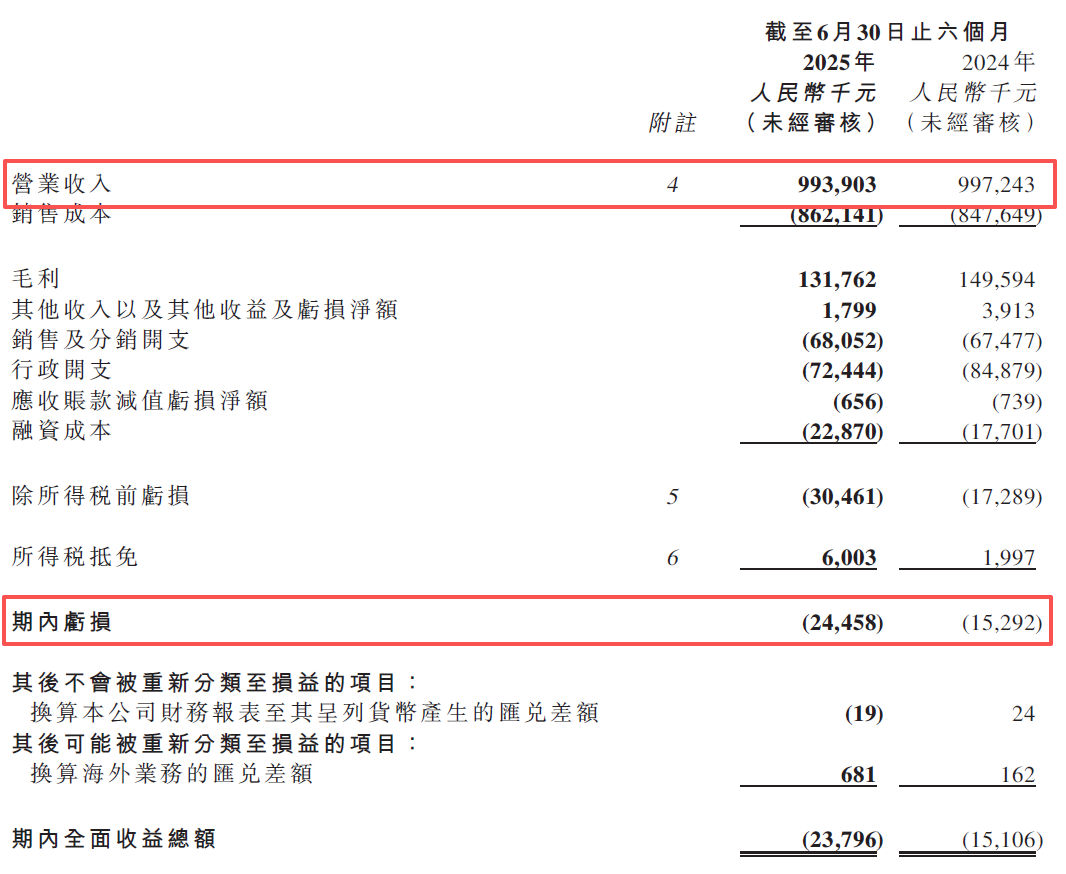

International Jifeng Packaging Group recorded unaudited interim performance in the first half of 2025, demonstrating the challenges faced by the company in the complex and severe global economic environment. According to the announcement, as of June 30, 2025, the group's operating revenue was approximately RMB 994 million, a slight decrease of about 0.3% compared to the same period last year's approximately RMB 997 million. Although the revenue remained relatively stable, the company's net loss significantly increased. During this period, the net loss attributable to the company's owners was approximately RMB 24.46 million, an increase of approximately 60% compared to the net loss of approximately RMB 15.3 million in the same period last year. This expanded the basic loss per share from RMB 0.05 in the same period last year to RMB 0.08 in this period. In addition, the board of directors has decided not to distribute any interim dividends for this period.

The company attributed the main reasons for the increase in losses to two aspects: a decrease in sales unit price and investment in a new factory. This reflects the pricing pressure on products caused by market competition, as well as the erosion of short-term profits by forward-looking investments for future expansion, in the absence of an equivalent decrease in raw material costs.

Detailed explanation of business segments

The core business of Jifeng Packaging Group is the manufacturing and sales of packaging materials, which are mainly divided into two categories: corrugated paper packaging products and corrugated cardboard.

Corrugated packaging products: During this period, the sales revenue of corrugated packaging products was approximately RMB 906 million, an increase of approximately 0.5% compared to approximately RMB 902 million in the same period last year. This part of the business accounts for approximately 91.1% of the group's total operating revenue and is the company's main source of income. The growth of operating income is mainly due to the increase in sales volume.

However, despite the increase in sales, the gross profit margin of the product has decreased from 15.9% in the same period last year to 14.1% in this period. The gross profit also decreased by about 10.5% to RMB 128 million. The main reason for the decrease in gross profit margin is that the decrease in unit price is greater than the decrease in unit cost of raw paper. This indicates that the market price competition is fierce, and the company has to lower product prices in order to maintain sales. However, the savings in raw material costs are not enough to compensate for this loss, resulting in a decrease in overall profitability.

Corrugated cardboard products: Unlike corrugated packaging products, the performance of corrugated cardboard business is relatively weak. The sales revenue for this period was approximately RMB 88.1 million, a decrease of approximately 7.8% compared to the same period last year when it was approximately RMB 95.5 million. This part of the business accounts for approximately 8.9% of the total revenue. The decline in sales is mainly due to a decrease in sales volume. More noteworthy is that the gross profit margin of corrugated cardboard has also significantly decreased from 6.8% in the same period last year to 4.1% in this period, and the gross profit has decreased by about 44.3% to about RMB 3.6 million. This indicates that the business sector is not only facing the challenge of weak demand, but its profitability has also been severely impacted.

Review and Prospect of Business Operations by Management

The performance report of Jifeng Packaging Group for the first half of 2025 depicts a picture of the company striving for change under external challenges. Despite a slight decrease in revenue and an expansion of net losses, there are deeper dynamics behind this. The core challenge is downward pressure on prices. This is the direct cause of the decrease in gross profit margin and the expansion of losses. This is not only a problem faced by Jifeng Packaging, but also a common dilemma for the entire paper packaging industry during the economic downturn cycle.

Internal optimization lies in cost control and cash flow management. In the unfavorable external environment, the company demonstrated proactive response measures. The reduction of administrative expenses reflects effective cost control. More importantly, the significant increase in net cash generated from operating activities indicates that the company has made significant progress in accounts receivable and inventory management. This not only enhances the company's short-term liquidity, but also provides a more stable foundation for future operations.

The strategic layout lies in investing in new factories and business transformation. One of the reasons for the loss is attributed to "investing in a new factory", which indicates that the company has not abandoned its long-term development plan due to short-term difficulties. This type of capital expenditure is aimed at enhancing future production capacity and technology to respond to changes in market demand and seize opportunities brought about by consumption upgrading. This is a necessary forward-looking investment that, although it may put pressure on the income statement in the short term, is crucial for the company's long-term competitiveness.

The management's cautious optimism about the performance in the second half of the year is mainly based on the arrival of the traditional peak season. This means that the company expects market demand to rebound, especially in the consumer goods and export sectors. In addition, the company mentioned that it will optimize its product structure and customer portfolio, which is a key strategic direction. This means that the company will focus more on high value-added, high gross profit products and seek to establish partnerships with more stable and promising downstream industry customers, such as revenue growth areas such as food and beverage, non food and beverage consumables, and medical products.

Overall, the performance of Jifeng Packaging Group in the first half of 2025 is complex and full of contradictions. On the surface, it appears to be a negative result of a slight decrease in revenue and an expansion of losses, but upon closer analysis, we can see the company's proactive response and strategic adjustments in the challenging market environment. The effective control of administrative expenses and significant improvement in operating cash flow reflect robust internal management. Meanwhile, the investment in the new factory reveals the company's firm confidence in future growth.

Currently, Jifeng Packaging Group is undergoing a period of transformation. Despite the short-term impact of market price wars on profitability, the improvement in working capital management and strategic investments in future growth have laid the foundation for the company to achieve recovery and growth in a more stable economic environment. The market performance in the second half of the year, especially the recovery of revenue and profits during the traditional peak season, will be an important test of the effectiveness of the company's strategic measures.