Label giant CCL reports 41.2 billion in revenue for the first three quarters-how is traditional manufacturing navigating a global layout?

CCL Industries, as a global leading provider of specialty labels, security, and packaging solutions, recently released its financial report for the third quarter of 2025. Despite facing a challenging geopolitical landscape and a highly volatile trade environment, the company still achieved remarkable and steady growth, with several key indicators showing impressive performance.

Quarterly Performance Overview: Double-Digit Growth in Revenue and Profit

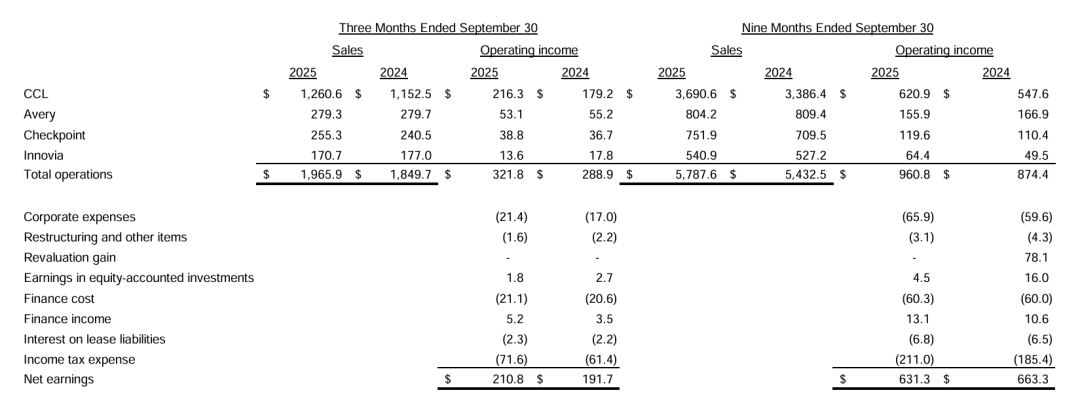

In this quarter, the company's sales increased by 6.3% year-on-year, reaching $1.9659 billion (approximately RMB 13.98 billion), compared to $1.8497 billion in the same period of 2024. Of this growth, organic growth contributed 3.7%, while currency translation added a positive impact of 2.5%. More notably, thanks to strict operational controls and strong organic sales growth, the company's operating income achieved double-digit year-on-year growth, surging 11.4% to $321.8 million.

In terms of profitability, net profit for this quarter reached $210.8 million (approximately RMB 1.5 billion), an increase from $191.7 million in the same period last year. Basic earnings and adjusted basic earnings per Class B common stockholder both performed well, reaching $1.21 each, compared to $1.08 and $1.09 last year, with foreign currency translation contributing a positive impact of $0.02. The effective tax rate for this quarter was 25.5%, slightly higher than 24.5% in the same period last year, mainly due to a higher proportion of taxable income generated in high-tax regions. Additionally, the company recorded $1.6 million in restructuring and other project expenses this quarter, primarily for severance related to CCL Design and Checkpoint, lower than $2.2 million in the same period last year.

Performance and Financial Strength for the First Three Quarters

From the beginning of the year to September 30, 2025, the company's cumulative performance remained strong. Sales grew 6.5%, reaching $5.8 billion (approximately RMB 41.244 billion), with organic sales growth of 3.1%. Operating income increased by 9.9%, totaling $960.8 million. Adjusted basic earnings per Class B common share were $3.61, higher than $3.30 in the same period last year.

Supported by solid performance, the company's financial standing remains healthy. This quarter, free cash flow was particularly strong, and despite returning up to $467.9 million to shareholders through dividends and share repurchases during the first nine months of 2025, the company's consolidated leverage ratio remains low at only 0.93 times adjusted EBITDA, indicating a low-risk level. The company has ample funds for global expansion plans, with cash reserves of $1.1369 billion and an $800 million syndicated revolving credit facility. The board has declared a quarterly dividend of $0.32 per Class B non-voting share.

CEO Commentary: Strong Performance in CCL Business, Mixed Challenges and Highlights in Other Segments

President and CEO Jeffrey T. Martin expressed being "very pleased" with this quarter's results. He noted that 3.7% organic sales growth and rigorous operational controls were key drivers behind the significant operating revenue growth, mainly due to the strong performance of the CCL business segment and the continued improvement of the Checkpoint business.

CCL Business Segment: Core Growth Engine

The CCL business segment was the main growth driver this quarter, with sales rising 9.4% to $1.2606 billion, including a strong organic growth of 6.6%. Operating income surged 20.7% year-on-year to $216.3 million, and operating margin increased significantly by 170 basis points to 17.2%. This robust performance was driven by several positive factors:

Home & Personal Care: Profitability improved in all regions except Latin America, benefiting from strong sales of aluminum aerosols and bottled products, as well as label sales in the Middle East and the recovery of the Asia market.

High-Growth Business: Strong demand in the electronics market (especially in Asia), the expansion of new businesses, and improved profitability in the automotive segment collectively drove significant growth in the CCL Design business.

CCL Security Business: Performance saw notable improvement, driven by increased sales of polymer banknotes and passport components.

Healthcare & Agrochemicals: The healthcare business improved in most regions; the agrochemical business performed strongly in the U.S. but was weak in Europe.

Food & Beverage: Actual results remained flat due to weak end-market demand and the startup costs of new plants, but profitability slightly improved due to currency fluctuations.

Other business segments showed mixed performance:

Avery Dennison: Sales grew 6.2% to $255.3 million, while operating profit slightly increased 5.7% to $38.8 million. Improvement was mainly due to strong growth in the European and Asian MAS businesses, which offset the decline in North American profitability (partly affected by unrecovered tariff costs). Apparel labeling business slightly declined due to global supply chain rebalancing and tariff risk, but RFID sales continued to grow, with significant gains in September.

AL: Performance was slightly below expectations, with sales down 0.1% to $279.3 million and operating income down 3.8% to $53.1 million. This was mainly due to unplanned tariff costs and lower shipments of back-to-school organizational products. However, direct sales channels in North America and Europe continued to see growth in both sales and profitability.

Innovia: Sales declined 3.6% to $170.7 million, while operating profit fell sharply by 23.6% to $13.6 million. Performance was weighed down by startup costs of a large new plant in Germany and a decline in North American demand, but gains from improved production efficiency in the UK and continued sales growth in Poland's EcoFloat business partially offset the negative impact.