Huigu New Materials IPO review meeting

A company that holds over 30% market share in the field of metal packaging coating materials has warned in its prospectus that its profits may be halved in the year it goes public.

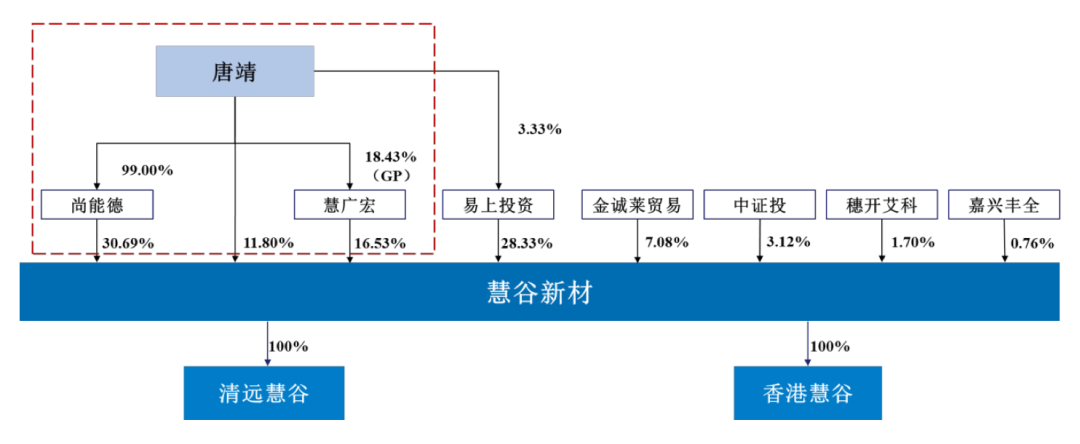

The Listing Review Committee of the Shenzhen Stock Exchange is scheduled to hold a meeting on December 9 to review the GEM listing application of Guangzhou Huigu New Materials Technology Co., Ltd. (hereinafter referred to as "Huigu New Materials").

The company occupies more than 60% of the market share in the field of energy-saving coatings for home appliance heat exchangers, and also has a market share of more than 30% in the field of metal packaging aluminum cover coating materials. However, in stark contrast to its bright market position, it is the decline in product unit prices across the board, high accounts receivable and production safety accidents that have resulted in two deaths.

01 Business Highlights

Huigu New Materials focuses on the field of polymer materials and is a platform-based functional coating material enterprise based on independent research and development. The company's main business is the research and development, production and sales of functional resins and functional coating materials.

The company has formed a "1+1+N" industrial layout system for the four downstream application scenarios of home appliances, packaging, new energy and electronics. Among these four areas, the packaging business is one of the important pillars of the company.

From 2022 to 2024, the company's operating income increased from 664 million yuan to 817 million yuan. The comprehensive gross profit margin increased from 29.56% to 40.68%.

02 Market position

Huigu New Materials occupies a leading market position in a number of functional coating material segments. Especially in the field of energy-saving coating materials for heat exchangers and aluminum cover coating materials for metal packaging, the domestic market share exceeds 60% and 30% respectively.

In the field of new energy and electronics, the company is one of the few suppliers in China that realizes the domestic subsistence of current collector coating materials and photoelectric coating materials for Mini LED. These materials have been used in fields such as lithium iron phosphate batteries and Mini LED packaging.

The company's customer resources are high-quality, including home appliance companies such as Gree, Midea, Haier, and Hisense, as well as packaging customers such as Snowflake Beer, Wang Laoji, and Yinlu. This reflects the company's practical application results in the field of packaging materials.

03 Core technology

The R&D strength of Huigu New Materials can be seen from the number of patents. As of the end of June 2025, the company has 84 authorized patents, including 79 invention patents, including 2 American invention patents and 2 Japanese invention patents.

In early 2025, the company applied for a patent titled "A laser transfer coating and its preparation method", a technology that enhances the visual effect of laser transfer coating. This indicates the company's continuous technological innovation in the field of packaging and decoration materials.

From 2022 to 2024, the company's R&D expenses accounted for more than 6% of operating income, and the R&D investment in 2024 was 54.913 million yuan. The company also has various R&D laboratories with a total area of about 10,000 square meters.

04 Controversy and risk

Despite its impressive market position and financial data, Huigu New Materials warned in its prospectus that there may be a risk of a decline in profits of more than 50% in the year of listing. There are a number of issues worth paying attention to.

The decline in product prices across the board is the most obvious risk signal. According to the prospectus data, except for the electronic materials business, the product prices of the company's other major business segments declined during the reporting period. the unit price of packaging business dropped from 23.71 yuan/KG to 20.65 yuan/KG, a decrease of 13.0%. In order to maintain growth, the company may have adopted a "price for volume" strategy.

Accompanied by price reductions, accounts receivable continue to expand. At the end of the reporting period, the book value of the company's accounts receivable increased from 184 million yuan in 2022 to 289 million yuan in 2024, and the proportion of total assets also increased from 18.02% to 22.93%.

At the same time, the company's customer concentration is high and on the rise. During the reporting period, the proportion of sales of the top five customers continued to climb from 43.65% in 2022 to 46.53% in 2024.

Huigu New Materials has had a major safety production accident. On September 16, 2019, a chemical flash explosion accident occurred in the production workshop of Guangzhou Huigu Engineering Materials Co., Ltd., a wholly-owned subsidiary of the company, resulting in the death of two employees. The accident investigation found that the company had serious problems such as "the safety responsibility of the main person in charge is suspended" and "risk management awareness is weak". It is worth noting that this subsidiary has been cancelled after being absorbed and merged in June 2022.

There is also controversy over corporate governance. During the reporting period, Huigu New Materials paid a cumulative dividend of 82.2041 million yuan, accounting for 21% of the cumulative net profit attributable to the parent company in the same period. At the same time, the company plans to raise 250 million yuan to supplement working capital. This operation of raising funds to replenish the flow while paying large dividends has attracted market attention.

In the material system of Huigu New Materials, packaging coatings are one of the businesses that can best reflect technical content. The metal packaging aluminum cap coating material developed by the company is being used in the packaging of well-known beverage brands such as Snowflake Beer and Wang Laoji.

Huigu New Materials disclosed in the prospectus that the company's independent research and development has solved a number of key technical problems, including antibacterial acrylic coating processing and water-based resin materials. According to the patent database, the company has applied for patents related to packaging materials, such as "capacitor coatings with deep drawing resistance and high temperature non-yellowing and preparation methods".

There are many possibilities for the future of Huigu New Materials. On the one hand, the company has obvious technical advantages and market position, especially in the field of packaging materials; On the other hand, problems such as declining product prices, high customer concentration and safety production history have cast a shadow on its road to listing.

The company's listing prospects will ultimately depend on how regulators weigh its technical strength against risk factors. For investors, those shiny coatings on the packaging may not only be materials to protect the product, but also an important proof of whether the company can successfully land in the capital market.