Annual revenue reaches a record high of 24.4 billion yuan, and the world's largest online printing giant reveals its transformation secrets and high profit mindset!

Cimpress is a globally leading custom printing and promotional product company dedicated to helping millions of businesses worldwide shape their brands, stand out, and achieve sustained growth. For over 30 years since its establishment, Cimpress has always adhered to the mission of "helping customers showcase their professional image and continuously grow and develop". Through continuous innovation, excellent product development, and operational improvement, Cimpress has become the pioneer and master of the large-scale customization business model for online printing.

The uniqueness of Cimpress lies in its ability to quickly and conveniently produce high-quality small batch customized products at an affordable price, which are crucial for brand building and business growth of enterprises. This makes Cimpress highly competitive in the market, especially when facing dispersed and smaller traditional competitors, Cimpress can stand out and continue to seize market share.

Review of Fiscal Year 2025 Performance: Steady Growth in Revenue, Decreased Net Profit

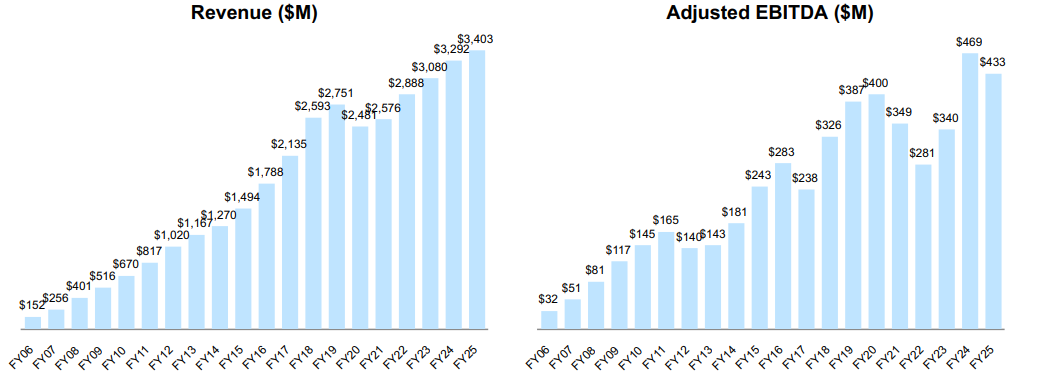

Recently, global online printing giant Cimpress released its financial performance report for the fiscal year ending June 30, 2025. The report shows that Cimpress achieved steady revenue growth in the fiscal year 2025, but saw a decline in net profit. According to the report basis and organic fixed exchange rate, the total revenue increased by 3%, reaching 3.403 billion US dollars (approximately 24.424 billion yuan), which also set a new historical high. The consolidated gross profit margin was 47.5%, a year-on-year decrease of 100 basis points. The change in gross profit margin is mainly affected by the adjustment of product portfolio. The net profit decreased significantly by $165 million, a decrease of up to 93%, to $12.85 million (approximately RMB 92.227 million). Adjusted EBITDA decreased by $35.5 million to $433 million.

From the specific performance of various business departments, Vista achieved a 5% increase in annual revenue based on reporting standards and organic fixed exchange rates, reaching $1.824 billion. Although its EBITDA decreased by $400000 to $348 million, this was due to Vista's strong growth in EBITDA in the second half of the year almost offsetting the decline in the first half.

PrintBrothers and The Print Group have performed well in terms of revenue, with reported growth of 5% and 7% respectively, and organic fixed exchange rate growth of 4% and 6% respectively. Among them, PrintBrothers' revenue was 669 million US dollars, and The Print Group's revenue was 378 million US dollars. The combined revenue of the two exceeded the 1 billion US dollar mark for the first time. However, the total EBITDA of Upload&Prin business decreased by $3.6 million to $154 million, and its total profit margin also decreased from 16% to 15%.

National Pen's revenue increased by 5% according to reporting standards and 4% based on organic fixed exchange rates, reaching a total of $407 million. The department's EBITDA increased by $1.7 million to $31.4 million, including $1.3 million in exchange rate gains. The EBITDA profit margin remains at a level of 8%.

As for all other businesses, their revenue increased by 7% year-on-year according to the reporting criteria, with an organic growth rate of 8% calculated at a fixed exchange rate, reaching a total of 227 million US dollars. However, the EBITDA of these businesses decreased by $600000, including $500000 in exchange rate gains. The EBITDA profit margin has also decreased from 11% to 10%.

Robert S. Keane, founder, chairman, and CEO of Cimpress, said, "Despite lower than expected financial performance in fiscal year 2025, we maintained strong momentum at the end of the year, continuing our long-standing market leadership and profit growth. In an uncertain tariff and trade environment, we demonstrated resilience and the ability to quickly respond to risks, and we continue to invest in those that are expected to bring strong profits and cash flow in the coming years

In a letter to investors, Keane emphasized that the company has made investments in the 2025 fiscal year and will continue to invest in technology, key production centers, artificial intelligence applications, and other initiatives that can promote business growth in the 2026 fiscal year. Meanwhile, Cimpress is actively seeking opportunities to significantly reduce sales revenue and curb the growth of operating expenses. Keane pointed out, "This will not significantly reduce costs for the 2026 fiscal year, but we believe that by the end of the 2027 fiscal year, this will result in an annual adjusted EBITDA growth of $70 million to $80 millionHe admitted that the biggest short-term challenge facing the company is being in a major transformation period, which is to clarify which product categories can drive future success. This may weaken the company's growth rate and gross profit margin in the short term, but he firmly believes that it will bring steady growth in gross profit and higher lifetime value for each customer in the future.

Product strategy: From "legacy" to "upgrade", deeply explore customer value

Cimpress's product strategy can be divided into two categories: "legacy" products and "upgrade" products.

The so-called "legacy" products refer to Cimpress products that were first launched 15-25 years ago and have now matured, such as business cards, holiday greeting cards, canvas prints, photo mugs, and return address labels. These products are mainly aimed at a large number of customers with relatively low lifecycle value per customer, most of whom have an annual gross profit of less than $50.

Cimpress's strategy for legacy products is to continuously reduce the cost of sales of similar products by optimizing production processes as legacy products enter maturity. Continuously improving product quality and introducing more attractive attribute options to accelerate the growth rate of unit price compared to unit cost, thereby increasing gross profit margin. For example, the variable gross profit margin of Vista business cards has increased from approximately 55% in fiscal year 2005 to 74% in fiscal year 2025. Cimpress is a market leader in most legacy products and ranks in the top three of all products. The investment in traditional products mainly focuses on reducing costs and improving quality and service levels. It is expected that the cash flow of traditional products will remain stable or slowly decline in value adjusted for inflation. Despite the market demand for most traditional products remaining stable or declining, high penetration rate of online printing, and fierce competition for new customer acquisition, Cimpress, with its scale unit cost advantage, is able to maintain a high market share and strong cash flow with relatively less investment.

Adjacent to traditional products is the larger market for "upgraded" products. In the past, Cimpress referred to them as "complex" products because their mass customization is often more complex than traditional products. The main upgraded product categories include signage, identification clothing, promotional products, merchandise, packaging, labels, and multi page small format products (such as books, catalogs, magazines, and booklets). The reason why these products are called "upgraded versions" is that customers believe they better reflect their value as a core medium for conveying brand and other information than traditional products. These products are still in the early stages of the "S-curve" transformation in the online printing and mass customization markets, and have enormous growth potential.

The advantage of Cimpress in upgrading products lies in the functionality and customer trust that Cimpress initially established through traditional products, which can be successfully extended to upgrade products. For over a decade, Cimpress has been committed to meeting customers' demands for these growth oriented products. The success of upgrading the product enables Cimpress to attract, serve, and retain customers with lifetime value far higher than traditional products.

Successful cases of "upgraded" products worth paying attention to:

Vista's packaging and labeling business saw a 12% increase in revenue for the fiscal year 2025, reaching nearly $140 million, with variable gross profit growth of 17%. Packaging customers place orders faster, more frequently, and for a longer duration, with a lifetime value far higher than traditional product customers.

The total revenue of BuildASign customized corrugated cardboard boxes is still small ($15 million in fiscal year 2025), but it is growing rapidly (up 25% year-on-year). The average estimated variable gross profit for these clients over 24 months exceeds $500.

Packstyle's flexible packaging business will see a 64% increase in revenue and a 73% increase in variable gross profit for the fiscal year 2025. Packstyle focuses on high demand vertical fields such as health and beauty, nutritional supplements, and pet food.

Vista's promotional products, clothing, and gifts revenue will increase by 18% in fiscal year 2025, exceeding $300 million, with an expected variable gross profit growth of 27%. Vista has launched over 25000 new SKUs, and the number of orders with variable gross margins exceeding $500 has increased by 55% year-on-year.

National Pen's business has rapidly expanded into the beverage, luggage, and clothing sectors, where customers have an average variable gross profit margin about 30% higher than those who only purchase pens.

VistaPrint's top 30% (3.2 million) customers in fiscal year 2025 have an average variable gross profit of $261 per customer, contributing 90% of the variable gross profit growth from fiscal year 2022-2025. Among them, the top 2% of customers (215000) created an average variable gross profit of $1408, contributing nearly $100 million more gross profit than the bottom 70% of customers (7.5 million). This fully demonstrates the importance of high-value customers for the overall performance growth of the company.

Looking ahead to the new fiscal year, Cimpress expects revenue to grow by 5% -6%, organic fixed exchange rate revenue to grow by 2% -3%, net profit to be at least $72 million, and adjusted earnings before interest, tax, depreciation, and amortization to be at least $450 million. Cimpress will continue to focus on its "upgrade" product strategy, maintain its leading position in the constantly changing market environment through technology investment and operational optimization, and lay a solid foundation for future sustained growth and profitability.