What did this printing giant, with a six-month revenue of 8.6 billion, do, go from a net loss of 200 million to a net profit of 40 million?

Against the backdrop of global economic uncertainty, marketing experience company Quad/Graphics has released its financial results for the second quarter and first half of the year ending June 30, 2025. Despite a decline in net sales, the company has successfully achieved a significant improvement in profitability through active strategic adjustments, strict cost control, and continued investment in innovation areas, reversing a net loss of $31 million in the same period last year to a net profit of $6 million. This article will analyze the "counter trend" growth secrets of Quad and reveal its layout in fields such as data intelligence, artificial intelligence, and retail media networks, providing reference for Chinese enterprises to find growth breakthroughs in the current complex market environment.

Quad/Graphics, This marketing experience company, which focuses on solving complex marketing challenges, recently released its second quarter and first half financial reports as of June 30, 2025. The report shows that against the backdrop of sustained macroeconomic pressure, Quad is actively adjusting its strategic focus and increasing investment in innovation to achieve long-term diversified growth.

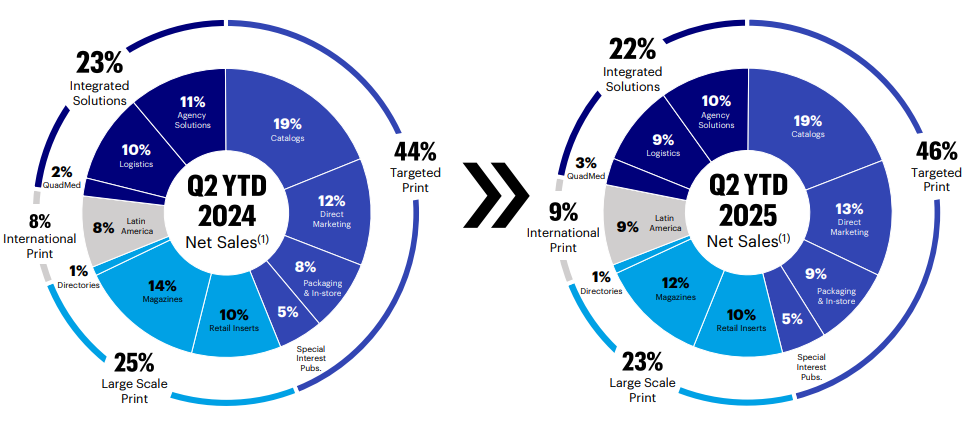

As of June 30, 2025, Quad's net sales were $1.201 billion (approximately RMB 8.617 billion), a year-on-year decrease of 7%. Excluding the impact of the divestment of European business, the actual decrease is 3%. The decline in revenue was mainly affected by a decrease in paper sales and a decline in sales of logistics and agency solutions (partly due to the loss of a large grocery customer).

However, it is noteworthy that despite facing revenue challenges, the company's profitability has achieved a significant 'comeback'. For the six months ended June 30, 2025, Quad successfully achieved a net profit of $6 million (approximately RMB 43 million), with a diluted profit per share of $0.11. This is in stark contrast to the net loss of $31 million (diluted loss per share of $0.65) for the same period in 2024.

Behind the profit improvement achieved by Quad, there are multiple synergies. Significant cost reduction: restructuring, impairment, and transaction related expenses have significantly decreased, depreciation and amortization expenses have decreased, and sales, general, and management expenses have been effectively controlled; Cost efficiency improvement: The improvement in manufacturing efficiency has brought positive benefits, and various cost reduction measures have also brought considerable savings; Reduced interest expenses: Helps improve the overall financial performance of the company. Despite the decline in net sales, increased investment in innovative products to drive future revenue growth, and divestment of European operations, Quad has successfully mitigated these negative factors by reducing various expenses and improving productivity.

Cuadraci is confident in Quad's vision and the company's ability to achieve diversified growth, improve printing and marketing efficiency, and create value for stakeholders.

Quad Chief Financial Officer Tony Staniak reiterated his performance guidance for 2025, stating that the company will continue to monitor the potential impact of tariffs, inflationary pressures, and increased postage on customers, while firmly investing in innovative products to achieve long-term financial goals, including net sales growth. In terms of capital allocation, Quad has adopted a balanced strategy. The company has returned $15 million in capital to shareholders through quarterly dividends of $0.075 per share and stock buybacks in 2025. Since the beginning of the year, the company has repurchased 1.4 million shares. Since the launch of the repurchase plan in 2022, the total repurchase volume has reached 7.3 million shares, accounting for approximately 13% of the issued shares as of March 31, 2022.

The latest financial report from Quad/Graphics not only demonstrates its strong cost control capabilities and strategic adjustment wisdom in complex market environments, but also indicates that data, AI, and retail media will become important growth engines in the future marketing field. For Chinese companies, Quad's successful experience provides a valuable model: finding opportunities in challenges, achieving breakthroughs in innovation, empowering marketing with technology, and enhancing core competitiveness.