Annual revenue of 107.6 billion Amco, will launch a plan to close four factories and split the North American beverage business!

On the evening of August 14th Beijing time, Amco, a leading global provider of multi substrate hard and soft packaging solutions, released its financial performance report for the year ended June 30th, 2025. The report shows that driven by the successful integration of Berry International's related businesses, the company achieved strong performance growth in the fiscal year 2025, with double-digit increases in revenue and profit.

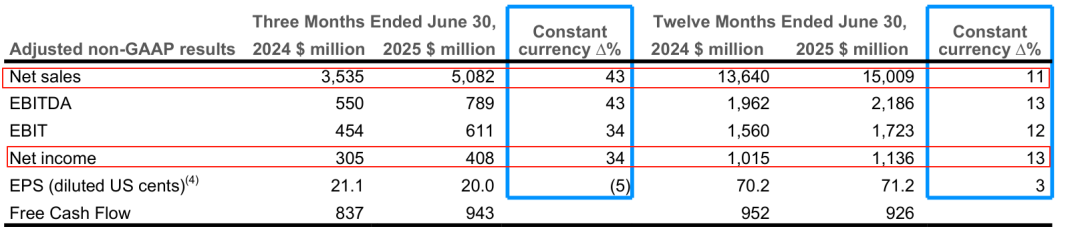

Net sales: reaching 15.009 billion US dollars (approximately 107.6 billion yuan), a year-on-year increase of 10% according to the reporting criteria. If the adverse effects of exchange rate fluctuations are excluded, calculated at a fixed exchange rate, the year-on-year growth will be 11%. It is worth noting that this includes approximately $1.5 billion in sales generated by the acquisition, and if asset divestment factors are deducted, the sales growth contributed by the acquisition is approximately 10%. The remaining year-on-year growth is mainly due to the positive impact of about 1% brought by the transfer of rising raw material costs.

Sales volume and price: The annual sales volume increased by about 1% year-on-year. However, the price and product mix had a negative impact of approximately 1% on performance, mainly due to a decrease in sales of high-value healthcare categories in the first half of the year.

Profit performance: Adjusted EBIT was $1.723 billion, a year-on-year increase of 12% at fixed exchange rates. Among them, acquisitions contributed approximately $195 million in EBIT (excluding divestitures), an increase of approximately 13%. Despite the adverse impact of price and product mix, strong cost-effectiveness and higher sales partially offset this negative factor. The net profit was 1.136 billion US dollars (approximately 8.2 billion yuan), a year-on-year increase of 13% calculated at a fixed exchange rate.

Performance of various business departments

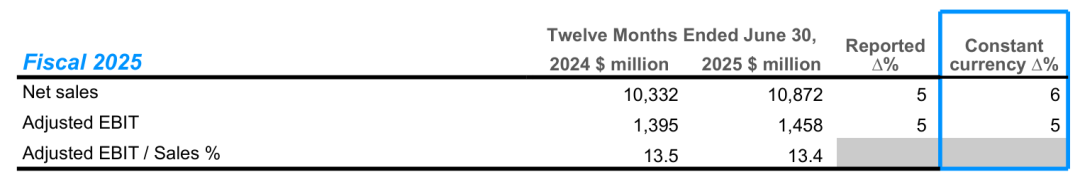

01 Global Flexible Packaging Solutions Department

This department includes Amco's existing flexible packaging business and the newly acquired Berry International flexible packaging business.

Net sales: 10.872 billion US dollars (approximately 78 billion yuan), a year-on-year increase of 5% according to the reporting criteria. Calculated at a fixed exchange rate, the year-on-year growth was 6%, with acquisitions contributing approximately $410 million in sales (excluding asset divestments), an increase of approximately 4%.

Other changes: The remaining growth is mainly due to the transfer of rising raw material costs (about 1% positive impact) and sales growth in all key regions (about 2% positive impact). However, due to the decline in sales of the healthcare category in the first half of the year, prices and product combinations have had a negative impact of approximately 1%.

Profit performance: Adjusted EBIT was $1.458 billion, a year-on-year increase of 5% at fixed exchange rates. Among them, acquisitions contributed approximately $50 million (excluding asset divestments), an increase of approximately 3%. The increase in profits is mainly due to the increase in sales volume and strong cost control, partially offsetting the adverse effects of price and product mix.

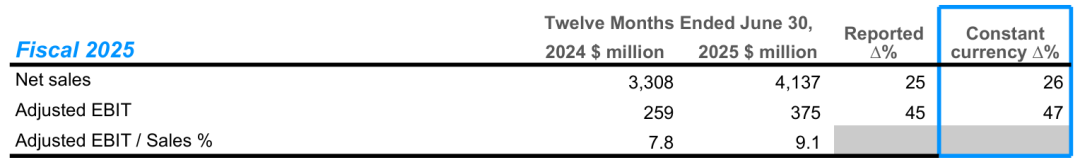

02 Global Hard Packaging Solutions Department

This department includes Amco's existing hard packaging business and the newly acquired international and North American consumer packaging business of Berry International.

Net sales: 4.137 billion US dollars (approximately 29.6 billion yuan), a year-on-year increase of 25% according to the reporting criteria. Calculated at a fixed exchange rate, the year-on-year growth was 26%, with acquisitions contributing approximately $1 billion in sales (excluding asset divestments), an increase of approximately 31%.

Other changes: The remaining differences are mainly caused by a decrease in raw material costs, a 2% decrease in sales volume, and a negative impact of approximately 2% on price and product mix.

Profit Performance: Adjusted EBIT was $375 million, representing a year-on-year increase of approximately 47% at fixed exchange rates. Among them, the acquisition contributed approximately $150 million (excluding asset divestment), with an increase of approximately 57%. The year-on-year difference in profits mainly reflects the impact of declining sales and rising costs in the North American beverage business in the second half of the year.

Interpretation of Executives and Future Prospects

During Thursday's earnings conference call, executives from Amco provided a detailed overview of their performance as of June 30th and the latest developments in their integration with Berry International. This quarter, the combined sales of the original Amco and original Berry businesses decreased by 1.7% year-on-year, lower than the previously expected flat level. Among them, hard packaging decreased by about 2%, and soft packaging decreased by about 1.5%. The company attributed the weakness to operational challenges in the North American beverage business and reduced consumer spending on snacks, candies, and other categories.

CEO Peter Konetsni stated that the company's leadership team is fully in place and integration has brought significant benefits. Amco can now provide a complete packaging solution, such as providing caps for coffee capsules supplied by Original Berry.

The company will focus on the "high growth, high profit" areas worth $20 billion, accounting for 50% of its core business portfolio, including healthcare, beauty and wellness, pet food, food services, liquid and protein packaging. Meanwhile, the company plans to split its North American beverage business; Integrate special container business; Merge the hard and soft packaging businesses in Latin America

The $1.5 billion North American beverage business encountered operational issues at multiple high-yield factories this quarter, resulting in increased shipping and labor costs. Konetsni candidly stated, 'We are not satisfied with the performance of this business, as customers are facing service issues.' The company has appointed a new management team and will improve performance through capacity adjustments.

Since the completion of the acquisition in April, the company has laid off approximately 200 employees, closed one factory, and initiated closure plans for four additional factories. At the same time, the company has locked in businesses with weak correlation and total sales of approximately $1 billion, which may be optimized through asset divestment, restructuring, or joint ventures in the future.

Chief Financial Officer Michael Casamanto stated that given the macroeconomic environment and tariff uncertainty, the company expects sales to remain largely unchanged in the 2026 fiscal year. Financial goals include doubling free cash flow to $1.8-1.9 billion; Adjusted earnings per share increased by 12% -17%; Capital expenditures are approximately 850 million to 900 million US dollars. The goal of integrating synergies is to achieve $260 million in fiscal year 2026 and $650 million in the third year.

Overall, the performance report of Amco for the fiscal year 2025 clearly demonstrates how a successful strategic acquisition can become the core engine for the company's leapfrog development.

Acquisition is the absolute protagonist of growth: both in terms of sales and profits, the acquisition of Berry International's business has contributed the vast majority of the incremental growth, especially in the hard packaging department, whose astonishing 47% profit growth is almost entirely driven by mergers and acquisitions. This highlights the initial success of Anmco's strategy of rapidly expanding market share and business scale through outward growth.

Internal growth faces challenges: After divesting from the impact of acquisitions, the company's internal growth momentum has slightly flattened. The overall sales growth of about 1% indicates moderate market demand, while the decline in sales of high-value medical categories has put some pressure on product portfolio and profitability. This indicates that while enjoying the benefits of mergers and acquisitions, the company still needs to focus on the organic growth vitality of its core business.

Future Focus on Integration and Collaboration: Both financial reports and CEO statements focus on the "synergy effect" of future growth stories. The expected earnings per share growth of 12% -17% for the 2026 fiscal year is based on confidence in successful integration, cost reduction, and cross selling. The key to the coming year will be whether Amco can efficiently translate this expected blueprint into tangible financial data.

Overall, Amco's 2025 fiscal year report outlines a blueprint for achieving leapfrog development through successful mergers and acquisitions. The future challenges and opportunities for the company will coexist on how to efficiently integrate new businesses, fully unleash collaborative potential, and continuously optimize its core product portfolio worth $20 billion to maintain a leading position in the constantly changing market.