What signals are behind the capital restructuring?

Recently, a major merger and acquisition in the global flexible packaging industry has attracted widespread attention in the industry. Global leading flexible packaging company ProAmpac recently announced that it has signed a final agreement to acquire TC Transcontinental Packaging, a subsidiary of TC Transcontinental, for $1.51 billion (approximately RMB 10.7 billion). The acquisition is expected to be completed in the first quarter of 2026, pending shareholder approval, regulatory clearance, and the fulfillment of other customary conditions.

What is the story behind this acquisition? What impact will it have on the development of the flexible packaging industry? What insights does this capital restructuring offer to Chinese printing companies? Below, we will analyze each of these questions step by step.

Who are they?

Before analyzing this specific acquisition, let's get to know the two main players involved in the deal-ProAmpac and TC Transcontinental.

ProAmpac, founded in 2015, is a global leader in flexible packaging and material science innovation, headquartered in Cincinnati, Ohio, USA. Its production centers are spread across eight countries, including the United States, the United Kingdom, Canada, and Germany, enabling coordinated global delivery and localized services across three continents. ProAmpac focuses on end-to-end solutions in flexible and paper packaging, serving diverse industries such as food and beverage, healthcare, retail, e-commerce, and industrial sectors.

TC Transcontinental was established in 1976 and is headquartered in Montreal, Canada. It is a leading company in North American flexible packaging, the largest printer in Canada, and a leader in French-language educational publishing in Canada. Its business spans three core segments: the Packaging segment, which specializes in flexible plastic packaging serving the dairy, meat, pet food, and other industries; the Retail Services and Printing segment, which provides retail marketing solutions and printing services for newspapers, magazines, books, and more; and the Media segment, which focuses on printing and digital publishing of French and English educational and professional publications. Transcontinental Packaging is the packaging division of Transcontinental, headquartered in Chicago, with 25 production facilities across North America, Latin America, the United Kingdom, and New Zealand.

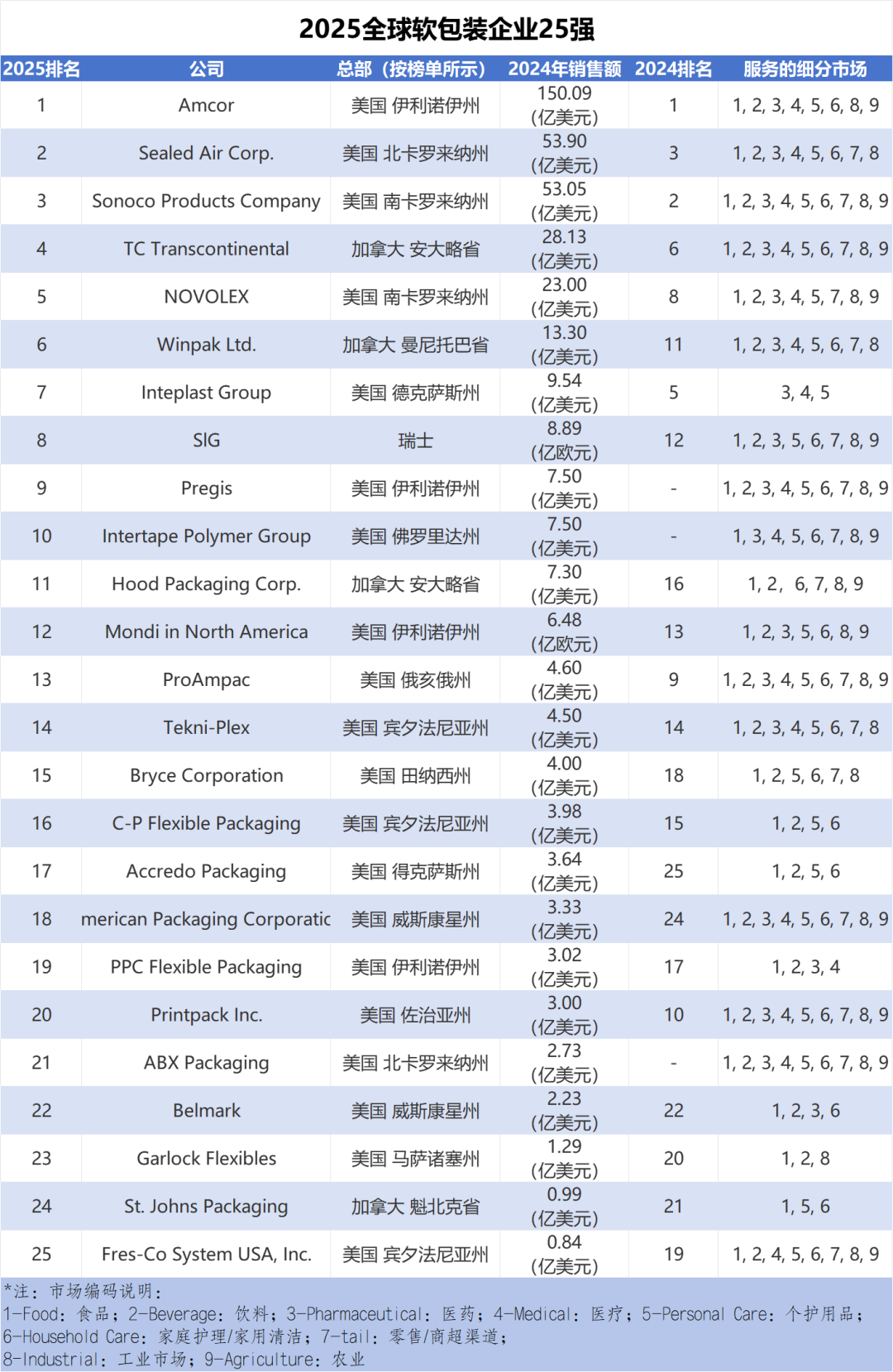

According to the previously released list of the top 25 flexible packaging companies in North America (for details, click on 'The 2025 Global Top 25 Flexible Packaging Companies Are Out! Who's at the Top of the Industry?'), ProAmpac's sales in 2024 are approximately $460 million, ranking 13th, while TC Transcontinental's 2024 sales are $2.813 billion, placing 4th on the list. The 13th largest North American flexible packaging company acquiring the packaging business of the 4th largest giant is a 'snake swallowing an elephant,' and behind this, there are many insights and considerations for the industry.

The story behind the transaction

Behind this transaction event is a complementary and strong combination based on their respective strategic considerations and development needs, which is of great significance to both ProAmpac and Transcontinental Packaging.

ProAmpac said the acquisition is highly aligned with its long-standing strategy of bringing sustainable packaging and materials to the global market and will further propel the company forward.

In terms of market expansion, ProAmpac can quickly enter high-value end markets such as dairy, meat, medical and pharmaceutical products through the acquisition of Transcontinental Packaging, while expanding its production layout in North America, Latin America, the United Kingdom and New Zealand to strengthen its global market coverage.

In terms of technical synergy, Transcontinental Packaging's technical capabilities in extrusion, printing, and lamination will help ProAmpac accelerate the research and development of next-generation packaging technologies such as barrier films, mono-material structures, and fiber-based packaging, enhancing the competitiveness of sustainable packaging solutions.

In terms of scale effects, ProAmpac has expanded its revenue scale and production capacity, enhanced its ability to cooperate with multinational brand customers, and enhanced its position in the global flexible packaging market.

It is worth noting that ProAmpac has shown aggressive expansion in recent years before completing the acquisition of Transcontinental Packaging, and has completed two important acquisitions in the second half of 2025.

In October 2025, the acquisition of Kokusai Paper's bag-making and processing business expanded its processing capabilities and promoted its "packaging fibrosis" strategy, enhancing its ability to provide customized packaging for markets such as grocery stores, convenience stores, and fast food restaurants.

In August 2025, a definitive agreement was signed to acquire PAC Worldwide to further expand its business segment. PAC Worldwide specializes in the production of protective mailing packaging and specialty packaging for the e-commerce, express delivery and retail sectors, with product lines ranging from polyethylene, paper and bubble wrap packaging.

The acquisition continues ProAmpac's expansion strategy to meet customer demand for more sustainable packaging solutions through organic growth and mergers and acquisitions, expanding the company's overall competitiveness while expanding its market reach.

For Transcontinental, the divestiture of packaging allows it to focus more on its core media and printing businesses, optimise the group's overall resource allocation and improve shareholder returns. As a packaging business unit of Transcontinental, Transcontinental Packaging has deep technology accumulation and a wide customer base in the fields of folding cartons and flexible packaging, especially in the end markets of food, beverage, and personal care. However, in the face of increasing global competition in the packaging industry, higher customer demands for sustainable packaging solutions, and pressure to optimize supply chains, independent operations may no longer be able to meet the needs of further business expansion and continuous technological upgrades.

Through this transaction, Transcontinental Packaging is expected to leverage ProAmpac's strengths to accelerate the development and marketing of its sustainable packaging products, improve operational efficiency, and further expand its presence in North America and the global market, thereby achieving new business growth.

What are the enlightenments of Chinese printing companies?

From the above analysis, it can be seen that this acquisition has an important impact on ProAmpac and Transcontinental Packaging. So what is the enlightenment behind the capital restructuring for Chinese printing companies?

1. Industry integration and differentiation have intensified, and the Matthew effect has become prominent

In recent years, leading enterprises in the global printing and packaging industry have achieved scale expansion through mergers and acquisitions, optimized the supply chain system, reduced raw material procurement costs, and improved the utilization rate of production equipment, occupying a more advantageous position in the fierce international competition. China's printing industry also shows a clear trend of integration, and large enterprises continue to expand their market share through mergers and acquisitions, industrial alliances, etc., forming the Matthew effect of "the stronger the stronger". However, many small and medium-sized printing enterprises are squeezing out multiple factors such as cost pressure, increased environmental protection requirements, and fierce market competition, and their living space is becoming increasingly narrow.

This differentiation is not only reflected in the scale and market share of enterprises, but also in the disparity in technological innovation capabilities, profitability and anti-risk capabilities. Small and medium-sized enterprises need to find a differentiated development path that suits them, find a foothold in the wave of industry integration, and achieve sustainable development. For example, some small and medium-sized printing companies can focus on market segments, deepen professional printing services in specific fields, and form differentiated advantages through precise positioning; It can also rely on regional industrial clusters to build a flexible and efficient supply chain system to improve the ability to respond quickly to market demand.

2. "Horizontal + vertical" expansion to expand growth space

With its "horizontal + vertical" two-pronged M&A strategy, ProAmpac not only promotes the global market layout, but also smoothly cuts into previously weak market segments such as dairy products, meat, pharmaceuticals, e-commerce, and express delivery. In the horizontal dimension, printing companies can learn from their experience and quickly make up for their own shortcomings through mergers and acquisitions or cooperation with enterprises with specific technical advantages, customer resources or regional market share in the same industry, so as to achieve rapid expansion of business scale and effective extension of market coverage.

the vertical dimension should focus on the upstream and downstream extension of the industrial chain, integrate high-quality raw material suppliers upstream, or participate in the research and development and application of new materials, and improve product quality from the source; downstream, it can actively expand value-added services such as packaging design, logistics distribution and even brand planning, open up the complete industrial chain from design to finished product delivery, penetrate the business tentacles from simple printing and processing links to high value-added service fields, and open up a broader growth space in the fierce market competition.

3. Focus on high-value market segments and optimize business structure

The acquisition has greatly increased ProAmpac's strength in the high-value-added pharmaceutical, dairy and other packaging fields, while Transcontinental will use this to divest its packaging business and focus on more advantageous core segments such as retail services and printing to achieve value optimization of "take what you need". This is very inspiring for Chinese printing and packaging enterprises, the current demand for high-end packaging in food, medicine and other industries continues to grow, domestic enterprises can jump out of the red sea of low-end processing and carry out targeted layout. For example, for the pharmaceutical industry, we will develop protective packaging that meets high standards, create customized packaging for high-end food that is both fresh and environmentally friendly, and at the same time divest non-core businesses with low gross profit and low growth in a timely manner, and concentrate resources to deepen the high-value track.

All in all, ProAmpac's acquisition of Transcontinental Packaging not only reflects the differentiation of the competitive landscape of the North American flexible packaging market, but also epitomizes the global flexible packaging industry integration trend. Behind the capital restructuring, printing companies should be soberly aware that at a time when industry competition is becoming increasingly fierce, market demand-oriented, through technological innovation, product upgrading and business focus, to achieve transformation and upgrading from "scale-driven" to "value-driven", in order to occupy a favorable position in the new round of industrial transformation.