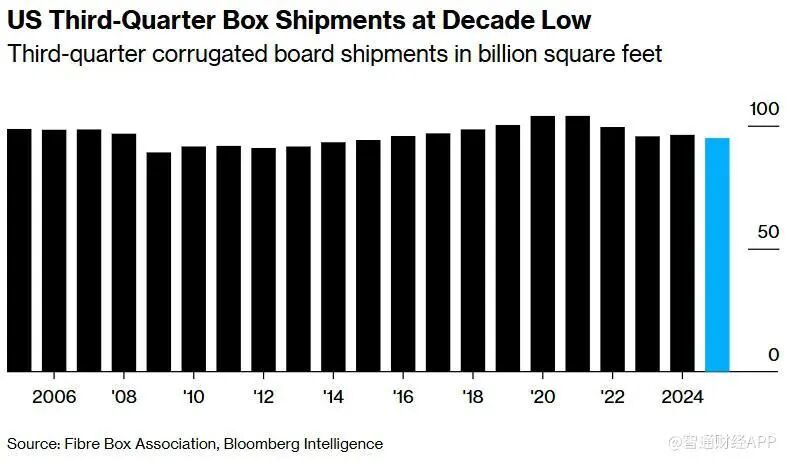

U.S. retailers are struggling! Cardboard shipments hit a ten-year low, raising fears of a collapse during the peak shopping season.

According to data released last Friday by the Fibre Box Association, U.S. corrugated box shipments fell to their lowest level for the third quarter since 2015, continuing the weakness observed since the second quarter. Several companies, including leading packaging material firms, have recently issued warnings that economic uncertainty is putting pressure on retailers and consumer spending.

Corrugated cartons are important packaging materials for food, daily necessities, and e-commerce transportation, and have long been regarded as a leading indicator of retail demand. Especially in October each year, carton orders usually reach a pre-holiday peak, used for retailers' stocking and holiday displays, but this year the situation is noticeably sluggish.Media surveys show that most carton factories reported October orders as "flat or below normal levels." At the same time, the U.S. consumer confidence index fell to a five-month low, and manufacturing activity has contracted for eight consecutive months.Thomas Hassfurther, president of U.S. Packaging Company (PKG.US), stated last month: "We are obviously not getting much momentum from the overall economy. The recurring tariffs and other uncertainties throughout the year are affecting our business."Paper packaging giant Smurfit Westrock (SW.UW) released data last week showing that its North American third-quarter same-day box volume fell 8.7% year-on-year, and its stock price immediately plunged more than 12%, hitting its lowest closing price since its IPO in July 2024.International Paper (IP.US) even lowered its net sales forecast for this year and 2027 in its financial report, with its stock price plummeting nearly 13% in a single day. CEO Andy Silvernail of the company stated that the U.S. corrugated carton industry is expected to see shipment volumes drop 1% to 1.5% year-on-year in 2024, due to trade uncertainties, weak consumer confidence, and a sluggish real estate market. He admitted that this trend has clearly reversed the market's early-year expectations of "slight growth for the year": "Unless we anticipate a major rebound in both the U.S. and European markets, we have to adjust our targets. We choose to face reality rather than continue to console ourselves, and focus on the parts we can control."Industry insiders generally believe that weak U.S. corrugated carton demand not only reflects insufficient manufacturing and retail restocking activities, but also suggests that this year's holiday consumption peak may be lower than in previous years, meaning that e-commerce, department stores, and durable goods companies face higher operational uncertainties.