The net profit of packaging has dropped by nearly 30% in half a year, and the revenue of Chinese business has decreased by 13%

Singapore listed company Dacheng Packaging Group recently released its performance report for the first half of 2025, which shows that the group is facing challenges of declining revenue and profits. At the same time, a mandatory takeover offer has also filled the company's future with uncertainty.

Performance Challenge: Both revenue and profit decline

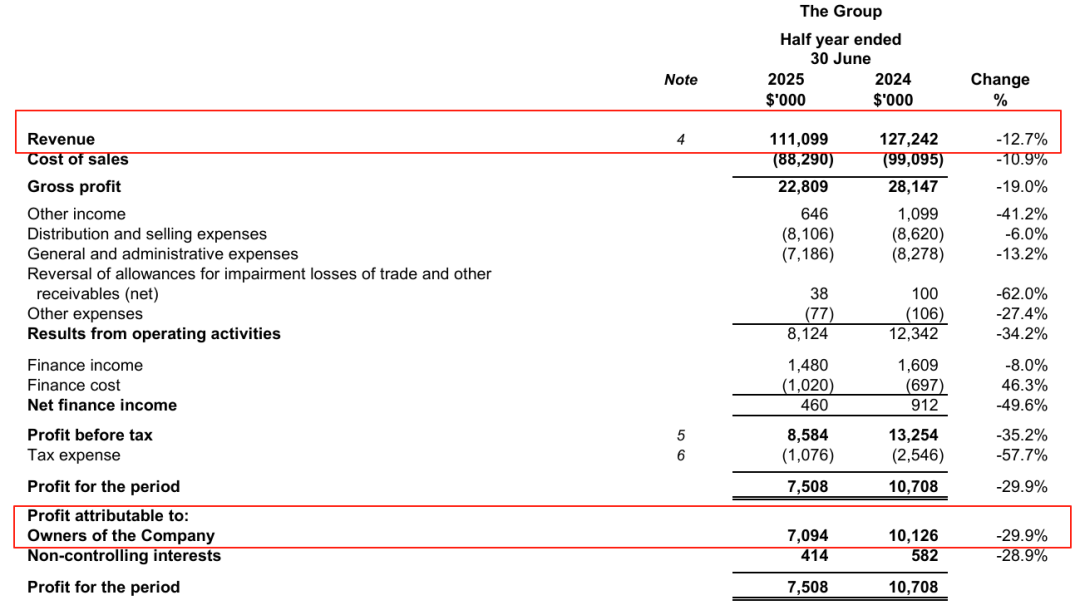

According to the report, the packaging group's revenue for the first half of 2025 was 111.1 million Singapore dollars (approximately 622 million RMB), a significant decrease of 12.7% compared to the same period in 2024, a decrease of 16.1 million Singapore dollars. This performance decline is mainly due to the contraction of its business in the two major markets of China and Singapore.

Chinese market: As the main source of business for the group, the total revenue in the Chinese market decreased by 13.1%, or SGD 13.6 million, and the total sales volume (square meters) decreased by 8.7%. In addition, fierce market competition and the depreciation of the renminbi against the Singapore dollar have further exacerbated the decline in income.

Singapore market: The total revenue of Singapore business also decreased by 11%, or SGD 2.5 million, mainly due to a 9.3% decrease in total sales volume (square meters).

The decline in revenue directly affects the profitability of the group. During the reporting period, gross profit decreased by 19%, decreasing by SGD 5.3 million to SGD 22.8 million. This is mainly due to reduced sales and intense price competition. In addition, other income (such as government subsidies) and net financial income also decreased by 41.2% and 49.6%, respectively.

Ultimately, these factors led to a significant reduction in the group's net profit. In the first half of 2025, the net profit attributable to the company's shareholders decreased by SGD 3 million year-on-year, a decrease of up to 29.9%. Despite a 57.7% reduction in tax expenses, it is still unable to reverse the overall decline in profits.

In addition to performance challenges, Dacheng Packaging Group is also facing sustained pressure from the external environment. The report points out that the trade conflict between China and the United States and the overcapacity in China's corrugated packaging industry have led to increasingly fierce market price competition. These factors, coupled with the possibility of rising raw material prices, will pose a direct threat to the group's future performance and profit margins.

In the face of these challenges, the management of the group stated that they will continue to remain vigilant and take multiple measures to address them: closely monitoring market dynamics, strengthening credit risk management, and maintaining a healthy financial condition. Continuously strengthen human capital construction, implement cost management, and improve operational efficiency and productivity.

Critical moment: Mandatory tender offer

The future fate of the packaging group not only depends on its own business situation, but also faces a crucial mandatory acquisition. On July 10, 2025, Dr. Wei Chenghui, the controlling shareholder of Puwei Group, initiated a mandatory conditional cash tender offer for Puwei Group through Dahua Jixian. Due to the fact that Puwei Group holds approximately 63.95% of the shares in Dacheng Packaging, according to the regulations of the Singapore Securities Industry Council, once Dr. Wei Chenghui successfully controls Puwei Group, a mandatory acquisition of Dacheng Packaging must be initiated.

Less than a month later, on August 7, 2025, the acquisition offer of Puwei Group was announced to be "unconditional in all respects". This means that Dr. Wei Chenghui and his concerted action team have successfully obtained over 50% of the voting shares of Puwei Group, triggering the "chain acquisition conditions" for achieving packaging. This influential entrepreneur in Singapore's business community is incorporating packaging into his business map through this move.

The announcement elaborates on the possible consequences of this acquisition, including changes in the company's listing status and potential delisting risks. According to the regulations of the New Exchange, if the acquirer and its concerted action parties hold more than 90% of the shares, New Exchange will suspend stock trading and may even face delisting.

If Dr. Wei Chenghui ultimately acquires or holds more than 90% of the total share capital, he will have the right to compulsorily acquire all shares that have not been accepted under the Singapore Companies Act and push for the delisting of the package from the Singapore Stock Exchange. Although the announcement emphasizes that this is only a current intention and whether it will ultimately be implemented remains to be evaluated, this series of actions undoubtedly paints a clear blueprint for achieving the future of packaging.

Summary and Analysis

The performance report of the Packaging Group for the first half of 2025 reveals the severe challenges faced by the company, including weak market demand, intensified competition, and external economic pressure. The dual decline in revenue and profit reflects the vulnerability of the group in the current market environment.

At this moment, the mandatory takeover offer from Dr. Wei Chenghui has brought new variables to this struggling company. For shareholders who have achieved packaging, this is both a challenge and an opportunity. On the one hand, if the acquisition is successful and leads to delisting, shareholders who have not accepted the offer may be forced to sell their shares; On the other hand, this also provides them with an opportunity to exit the investment at a determined price.

From a macro perspective, the trigger for this acquisition offer comes during a period of sluggish packaging performance, which may have been Dr. Wei Chenghui seizing the opportunity to gain control of the company at a lower cost. However, it is still unknown whether the successful implementation of the offer and subsequent integration can effectively solve the business difficulties faced by packaging and bring new growth momentum to it. Ultimately, the outcome of this capital operation will determine the future fate of this long-standing packaging company.