The largest folding paper box manufacturer in Europe achieved a revenue of 17.1 billion yuan in half a year, with a net profit skyrocketing by 3.4 times!

MM Group, the largest folding color box and cardboard manufacturer in Europe, recently released its financial report for the first half of 2025. The report shows that although the consolidated sales were basically the same as the same period last year, the adjusted operating profit of the group achieved significant growth through effective cost control and business structure adjustment. This financial report not only demonstrates the group's adaptability in a challenging market environment, but also lays a solid foundation for its future development.

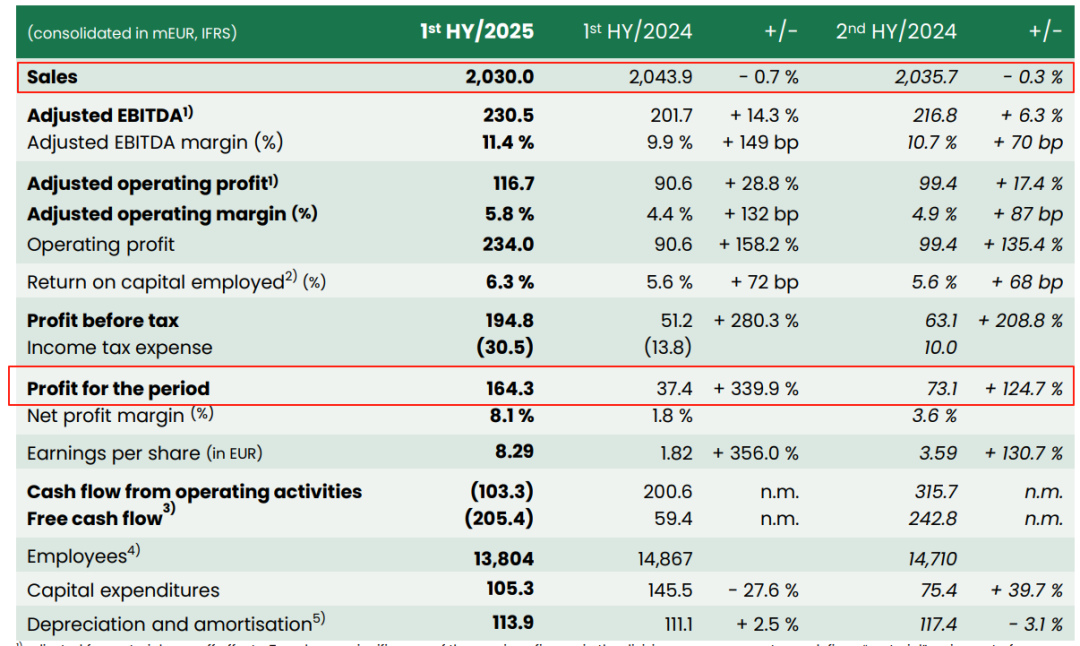

Overall financial performance in the first half of the year

The consolidated sales of MM Group in the first half of the year were 2.03 billion euros, slightly lower than the 2.0439 billion euros (approximately 17.1 billion yuan) in the same period last year. However, through effective cost control and business restructuring, the group's adjusted operating profit surged from 90.6 million euros to 116.7 million euros, an increase of 26.1 million euros. This has increased the adjusted operating profit margin of the group from 4.4% to 5.8%.

The pre tax profit in the first half of the year reached 194.8 million euros, far exceeding the 51.2 million euros in the same period last year, mainly due to the proceeds from the sale of Tarn Group. Correspondingly, the profit for this period also increased significantly from 37.4 million euros to 164.3 million euros (approximately 1.372 billion yuan).

It should be noted that the profit growth of this financial report is significantly affected by two one-time factors: one is the sale of Tarn Group, which resulted in a one-time gain of 122.8 million euros for the food and high-end packaging division; The second is business restructuring, with the pharmaceutical and healthcare packaging division generating a one-time impact of 5.5 million euros in the first phase of restructuring in Southwest Europe.

Looking at the second quarter alone, MM Group's performance has also slightly improved. The combined sales revenue was 987.4 million euros, slightly lower than the 1.0189 billion euros in the same period last year and 1.0426 billion euros in the first quarter of this year. The adjusted operating profit for the second quarter reached 55.7 million euros, higher than the 51 million euros in the same period last year, but lower than the 61 million euros in the first quarter. The profit margin is 5.6%. Adjusted EBITDA reached 111.2 million euros, higher than 107.2 million euros in the same period last year. Due to the sale of Tarn Group, the profit for this period reached 143.2 million euros, far higher than the 21.1 million euros in the first quarter and 26.5 million euros in the second quarter of last year.

Despite the increase in profits, the group pointed out that the market situation remains severe, consumer demand remains weak, and the utilization rate of European production capacity continues to be insufficient. In addition, the adjusted operating profit in the second quarter was lower than that in the first quarter, mainly due to the reduced contribution of the food and high-end packaging departments. In contrast, the pharmaceutical and healthcare packaging business, as well as the cardboard and paper business, have improved compared to the previous quarter.

Detailed explanation of the three major business departments

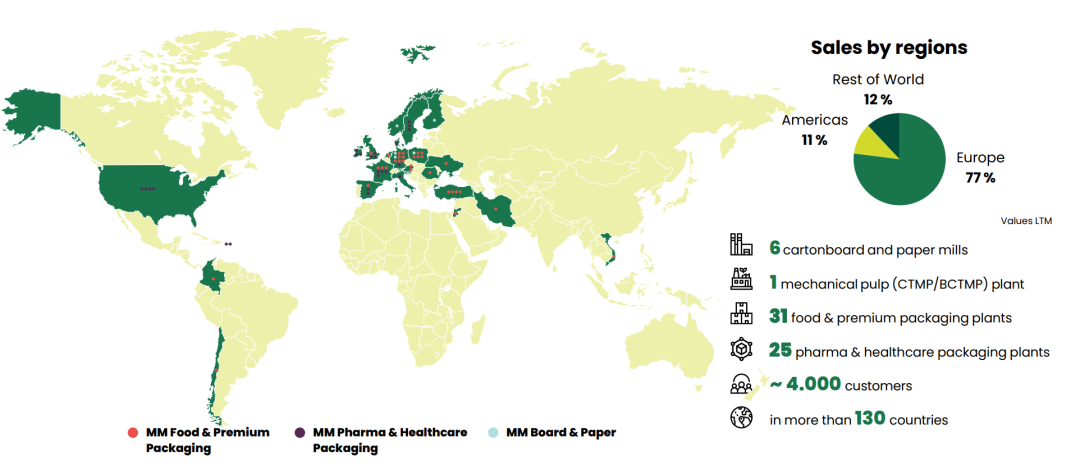

MM Group currently has 6 packaging paper and cardboard factories (with an annual production capacity of approximately 1.472 million tons), 1 mechanical pulp and paper factory, 31 food and high-end packaging factories, and 25 pharmaceutical and healthcare packaging factories.

01

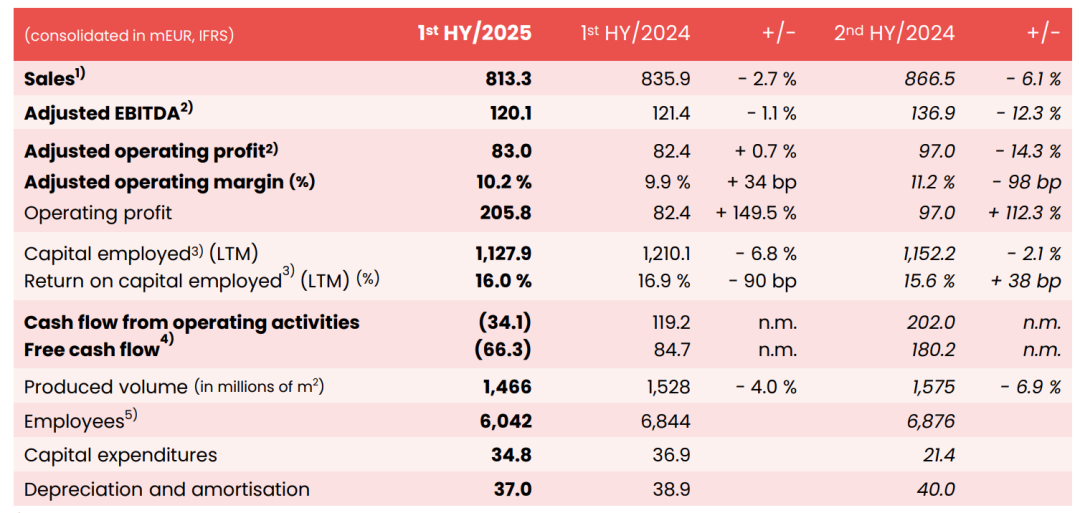

MM Food and High end Packaging

In the first half of the year, the demand for folding paper boxes remained sluggish and competition was fierce. The department is improving cost efficiency and productivity through a large number of projects. As a measure to focus on its core business, the company successfully sold the Tarn Group on June 2nd. The sales revenue in the first half of the year was 813.3 million euros, slightly lower than the same period last year. Excluding the Tarn Group, the sales revenue was 724.6 million euros (approximately 6.051 billion yuan). After adjustment, the operating profit reached 83 million euros, with a profit margin of 10.2%. Excluding the Tarn Group, the adjusted operating profit is 60 million euros, with a profit margin of 8.3%. Excluding the Tarn Group, the production was 1.097 billion square meters, a year-on-year decrease of 1.5%, partly due to a fire in Poland.

In the first half of the year, there was a differentiation in market demand, with growth in the US market and a decline in some Western and Central European countries. But the department has made up for the lack of sales growth by improving production efficiency and continues to enhance profitability. The sales revenue in the first half of the year was 320.8 million euros (approximately 2.679 billion yuan), which was basically the same as the same period last year. The adjusted operating profit is 18.9 million euros, with a profit margin of 5.9%. The production has increased to 465 million square meters.

03

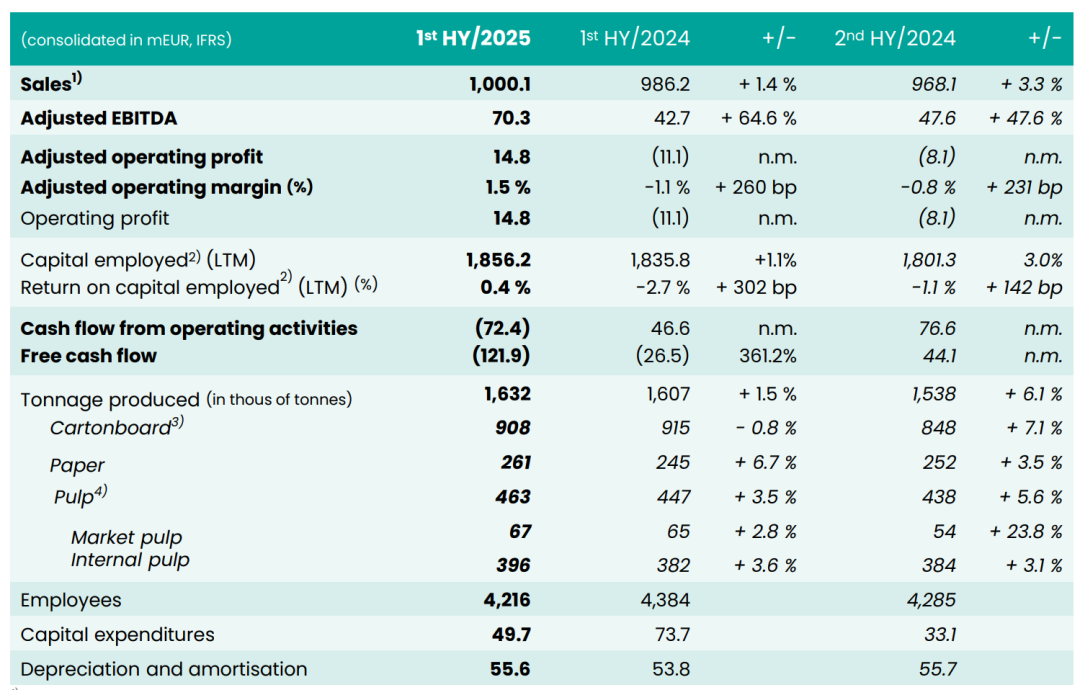

MM cardboard and paper

In the first half of the year, the cardboard market saw a sideways consolidation, while the double adhesive paper market experienced a sharp decline. The department has successfully achieved cost savings by implementing the 'Adapt to the Future' plan. The sales revenue was 1.001 billion euros (approximately 8.352 billion yuan), slightly higher than the same period last year. After adjustment, the operating profit turned from a negative value of -11.1 million euros in the same period last year to a profit of 14.8 million euros, with a profit margin of 1.5%. The production increased by 1.5% to 1.632 million tons, resulting in an increase in sales and capacity utilization. The average backlog of orders is 168000 tons, lower than the 191000 tons in the same period last year.

Future prospects and strategic plans

Faced with a challenging market environment, MM Group has launched a "Adapt to the Future" plan that covers the entire group, with the goal of continuously improving competitiveness. The management is confident that by 2027, excluding market volatility factors, the structural sustainable profit growth will exceed 150 million euros (excluding the Tarn Group).

MM Group expects to be particularly affected by the annual maintenance shutdown costs of its cardboard and paper business in the second half of the year. It is expected that maintenance shutdowns throughout the year will result in costs of approximately 40 million euros (up from 26 million euros last year), of which about two-thirds will be incurred in the third quarter. It is expected that capital expenditures in 2025 will be below 250 million euros, lower than initially anticipated, in order to continue implementing measures to reduce working capital and increase cash flow.

Overall, MM Group's financial report for the first half of 2025 is a breakthrough report achieved in adversity. Despite the unfavorable macroeconomic environment and weak market demand, the group has successfully achieved significant profit growth through various measures such as selling non core businesses, focusing on core businesses, strictly controlling costs, and improving production efficiency. Especially the turnaround of the cardboard and paper business, as well as the launch of the "Adapt to the Future" plan, demonstrate MM Group's determination and effectiveness in strategic transformation. This financial report not only showcases the excellent performance of the group in the first half of the year, but also points out the direction for it to firmly move towards a sustainable future in the continuously uncertain market environment.