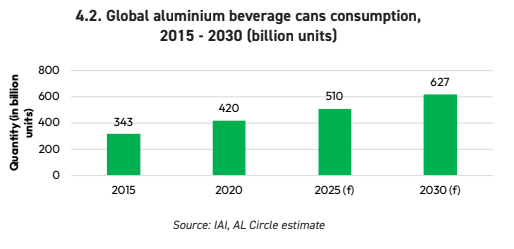

The global aluminum can market is about to experience rapid growth - consumption is expected to reach 627 billion units by 2030.

The latest industry report shows that the global metal packaging market for food and beverages is entering a period of steady expansion, with aluminum cans performing particularly well. The market size is expected to rise from $26 billion in 2025 to $40 billion in 2035, representing a compound annual growth rate of 4.5%. This growth trend highlights the urgent consumer demand for convenient, durable, and eco-friendly packaging solutions, while also reflecting a new market pattern where global sustainability strategies are deeply integrated with contemporary lifestyles.

Dual Drivers of Technology and Consumption Upgrade

The booming aluminum can market is driven by multiple factors. On the technology side, the excellent barrier properties of metal packaging effectively ensure product quality, making it especially suitable for categories that require high preservation standards, such as dairy products, ready-to-eat meals, and pet food. On the consumption side, accelerated urbanization and the prevalence of dual-income households have created a demand for packaging that aligns with modern life rhythms. Notably, the introduction of innovative products like BPA-free aluminum cans not only addresses chemical migration concerns but also serves as a key breakthrough for market growth in developed countries.

Differentiated Development in Global Regional Markets

North America, as the world's largest aluminum can consumer market, is expected to reach a demand of 173 billion cans by 2030, accounting for 25% of the global total. The European market, driven by categories such as beer and soda, maintains an annual growth rate of 4.09% and is undergoing a comprehensive shift from tinplate cans to aluminum cans.

Emerging markets are showing particularly strong performance: aluminum can consumption in India is expected to grow rapidly at an annual rate of 6.76%, while China's output is expected to exceed 122 billion cans by 2030, driven by the 'bottle-to-can' trend. In South America, represented by Brazil, not only does it rank as the third-largest market globally, but it has also set an industry benchmark for sustainable development with a 98.7% aluminum can recycling rate.

Challenges and Opportunities in Green Transformation

Although the global average recycling rate for aluminum cans has exceeded 70%, industry experts point out that this figure still falls short of the climate targets set by the Paris Agreement. Meanwhile, can wall-thinning technology, while reducing raw material costs, may affect packaging performance, presenting a technical challenge that the industry needs to balance.

The head of the Aluminum Packaging Industry Association stated: "As Generation Z consumers become the main purchasing force, their increased environmental awareness and demand for upgraded consumption will continue to benefit the aluminum can market. The next five years will be a critical period for technology iteration and market restructuring, with smart production lines and closed-loop recycling systems becoming core competitive advantages for enterprises."

Currently, industry giants including Ball Corp and Crown are accelerating global capacity expansion. Major investment projects, such as Canpack Group's new plant in Brazil and Volvo's production base in Mexico, indicate that the aluminum packaging industry is entering a new development cycle. Driven by both environmental policies and consumption upgrades, this green packaging revolution is redefining the global packaging industry landscape.