The Top 100 North American Print Buyers Are Released, In-Depth Analysis of Procurement Trends for Nestlé, Apple, Pepsi, and More!

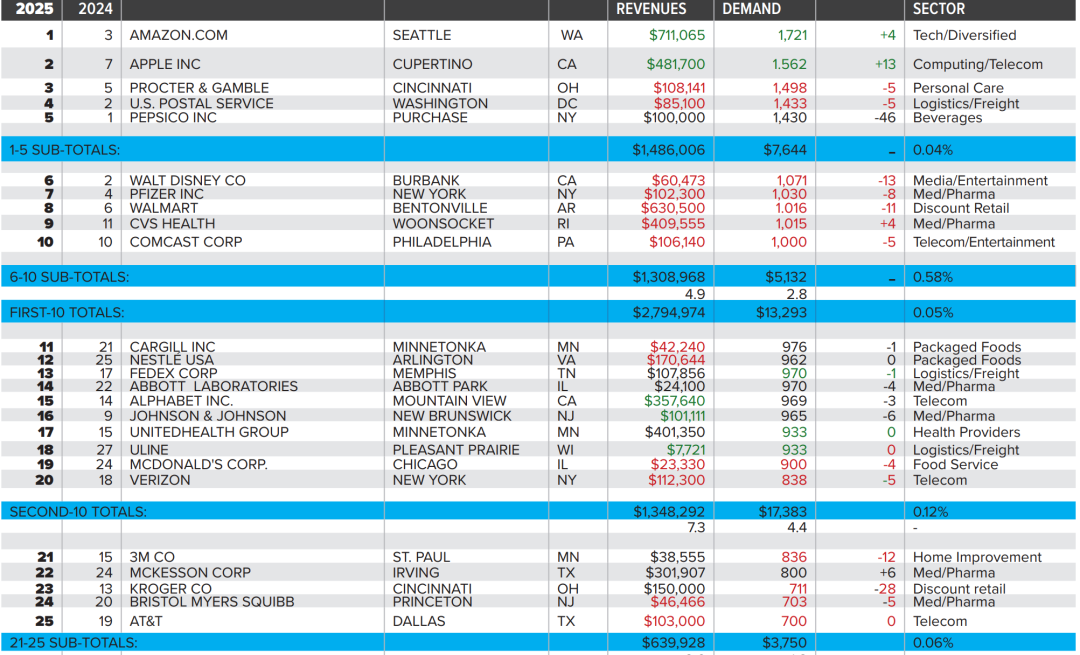

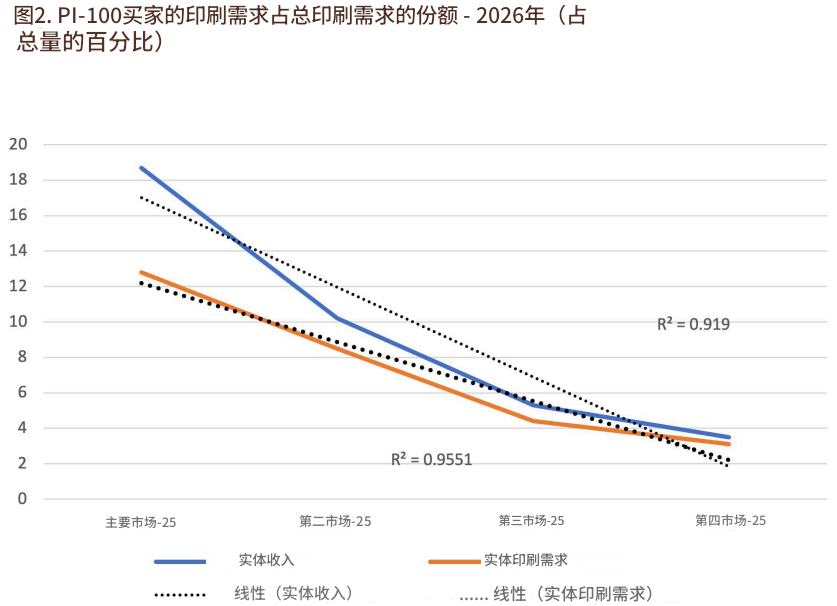

The 2025 North America Top 100 Print Buyers list has been released, featuring major brands like Apple, Amazon, Pfizer, McDonald's, Pepsi, and Coca-Cola, which are redefining the landscape of the printing economy. From packaged foods to tech direct mail, from pharmaceutical labels to discount retail, print purchasing is undergoing tremendous changes. Who is buying aggressively? Who is withdrawing? Who is planning for the future? This is more than just a list; it is a survival roadmap for the printing industry. If you are still making decisions based on "past experience," you may already be lagging behind. Recently, the authoritative North American media outlet Printing Impressions published the 2025 Top 100 Print Buyers list. The list shows that the total revenue of the top 100 reached $9.1 trillion USD (approximately ¥64.85 trillion RMB), with print purchasing amounting to around $86.058 billion USD (approximately ¥613.335 billion RMB), accounting for about 0.83%. The total annual production value of the United States is approximately $28.22 trillion USD (approximately ¥201.12 trillion RMB), with print demand around $220.098 billion USD (approximately ¥1.57 trillion RMB), accounting for about 0.78%.As major industry giants readjust their print spending strategies, printing companies must focus on priorities, develop strategies, and grow selectively in order to remain competitive and achieve sustainable profitability amid this significant reshuffle. Before we delve into the complexities of AI, it may be worthwhile to first pay attention to consumption in the physical economy: for example, dining at restaurants, provided they still offer paper menus. In fact, the packaged meals segment is making a comeback as one of the leading print buyers, becoming one of the largest and most attractive buyers among the three key sub-sectors in the industry.

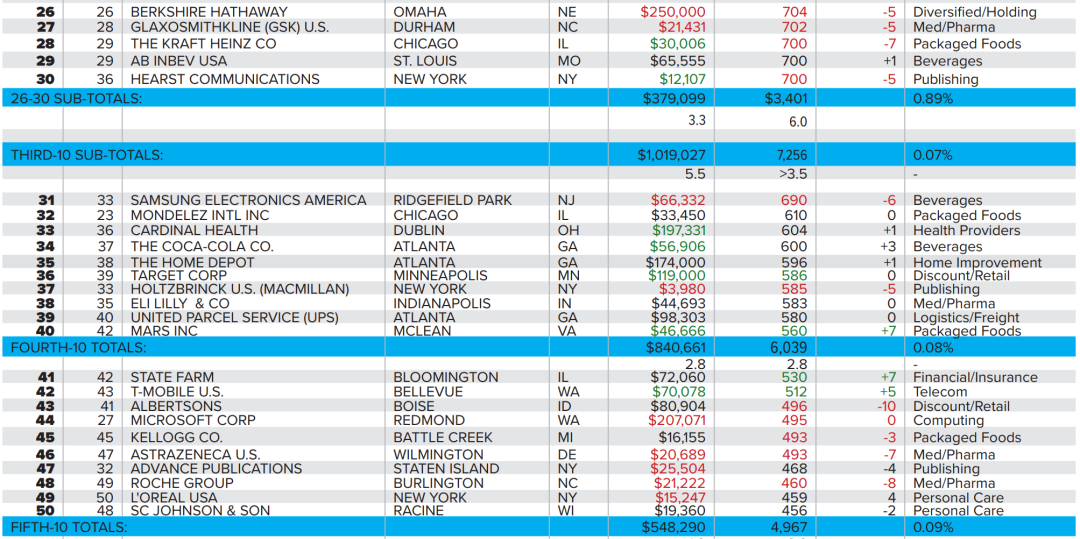

Changes in Printing Demand in the Packaged Food and Beverage IndustryIn the field of packaged foods, printing expenditures by several major players are notable. Cargill in the United States, with $42.2 billion in revenue (down 5% year-over-year) and nearly $1 billion in printing expenses (down 1% year-over-year), jumped from 21st place last year to 11th place. Following closely is Nestlé USA, with $170.6 billion in revenue (down 12% year-over-year) and printing expenses just under $1 billion, which remained flat (0% year-over-year), moving up from 25th place last year to 12th. Together, these two companies account for nearly 6% of the printing acquisition share among the top 25.Other major buyers ranked between 25th and 50th include: Kraft Heinz, which rose to 28th, with $30 billion in revenue (up 2%) and $700 million in pending printing expenditures (down 7%); Mondelēz International, holding steady at 32nd place, with $33.5 billion in revenue (0% growth) and $600 million in pending printing expenditures (no change); and General Mills, which moved up two places to 77th, with $19.7 billion in revenue (up 5%) and $300 million in pending printing expenditures (down 4%).

In contrast, the performance of the beverage and food service sector appears relatively flat, especially in terms of printing expenditures. From the perspective of the print economy, this industry is expected to remain stagnant. However, the largest buyers remain exceptions. PepsiCo fell from the top position last year to fifth place, with revenue of $100 billion (almost no growth) and printing expenditures of $1.4 billion (a sharp decline of 46%). As one of the most diversified marketers in the beverage and snack sector, PepsiCo is actively launching new brands and securing the convenience store market, generating demand for printed materials such as flexible packaging, metallic decoration, litho C1S board cartons, labels, and retail POS materials. Coca-Cola climbed from 37th to 34th place, with revenue of $59.9 billion (an 8% increase) and printing expenses of $600 million (up 3%). This is due to its dominant position in fast-food chains and advantages in supermarket shelving, end-of-aisle promotions, and coupon discounts. In the adult beverage sector, Anheuser-Busch InBev rose from 31st to 29th place, with revenue of $65.5 billion (a 1% decline) and printing expenditures of $700 million (an increase of 1%). After setbacks with the Bud Light brand, Anheuser-Busch InBev began promoting low- or non-alcoholic beverage brands and plans to introduce protein and enzyme by-products for sustainable agriculture. For the printing industry, this 'Budweiser' brand could hold considerable potential. Additionally, four drive-thru food service brands made it onto the top 100 list. McDonald's rose from 25th to 19th place, with revenue of $23.3 billion (down 10%) and $900 million from printing business (down 4%). It is reported that McDonald's Golden Arches orders will be shifted to regional centers and placed through a portal linked with authorized suppliers. Technology giants are entering the direct mail and printing market.

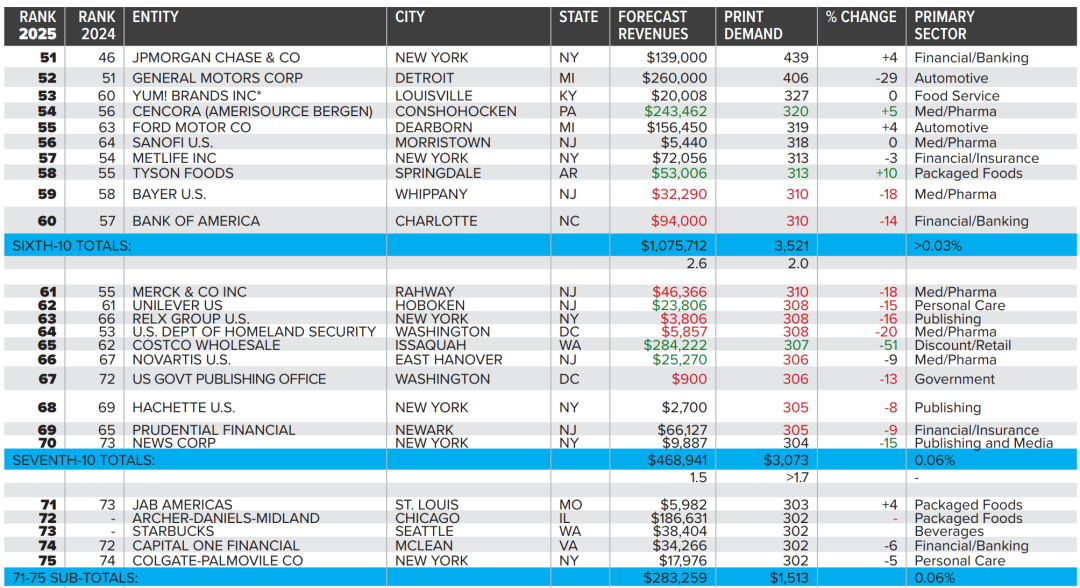

Amazon, ranked first, had revenue of $711 billion (up 4%), with printing costs of $1.7 billion (up 4%), moving up from third to fourth in ranking. Amazon has been reclassified as a technology entity, but its business scope is broad, including warehouses, delivery fleets, retail stores, and a range of innovative technologies, with artificial intelligence at its core. The company's print demand includes software promotion direct mail and documents (mainly used to attract thousands of future third-party franchisees), retail circulars, and e-books.Another Amazon policy-encouraging existing and potential suppliers to pay for participation instead of being compensated through sales-may represent a misuse of its "hub-and-spoke" model. The incentive is "extra" access to millions of members and assumed channels to reach Amazon buyers. This concept of leveraging a loyalty base will spread to more companies, which mistakenly believe that existing e-commerce users are exclusive and exploitable assets. Additionally, Amazon founder Jeff Bezos owns a significant newspaper.Meanwhile, Apple, ranked second, had revenue of $481.7 billion (up 14%), with print investments of $1.6 billion (up 13%). As the company with the largest marketing capital in history, its market value reaches $3 trillion, with ample cash and credit to purchase hundreds of "brewing electronic fruit" in the future (2026-2030). Apple will deploy 150 or more sourcing offices, mainly for direct mail, labels, packaging boxes, and store/transport signage, providing robust channels for sellers.Five telecommunications companies in the "cash cow model" are on the technology side awaiting phase-out, acquisition, or merger:- Comcast, ranked 10th, had revenue of $106.1 billion (down 6%), with remaining printing costs of $1 billion (down 5%), and may be the first to cut the network.- Verizon, ranked 20th, had revenue of $112.3 billion (down 12%), with remaining printing costs of $800 million (down 5%), dropping from 18th position and ceasing operations in many retail stores.- AT&T, ranked 25th, had revenue of $103 billion (down 5%), with remaining printing costs of $700 million (flat), will face the same fate.- T-Mobile US, ranked 42nd, had revenue of $70.1 billion (up 5%), with remaining printing costs of $500 million (up 5%), is the only company performing well in this category.Additionally, Samsung Electronics America, ranked 31st, had revenue of $66.3 billion (down 39%), with projected print costs of $700 million (down 6%), benefiting from tax-avoidance investments in Korea and China. Every participant on the tech list is a major direct mailer and a significant buyer for in-store and event-related signage and apparel.

Healthcare and Pharmaceutical Sector SpendingThe response-oriented prescriptions in the healthcare sector will remain in a mitigation state until (hopefully not) an inevitable natural outbreak or lab-contained virus spreads again, especially in the pharmaceutical sector. Major spending companies include:Pfizer (#7): $102.3 billion revenue (-14%), $1 billion in printing costs (-8%).Johnson & Johnson (#16): $101.1 billion revenue (+3%), under $1 billion in printing costs (-6%).Abbott (#14): $24.1 billion revenue (+29%), under $1 billion in printing costs (-4%).McKesson (#22): $301.9 billion revenue (+3%), $800 million in printing costs (+6%).Bristol-Myers Squibb (#24): $46.5 billion revenue (-7%), $700 million in printing costs (-5%). The company launched new product promotions that will increase final sales of its anemia drug Reblozyl, late-stage skin cancer treatment Opdualag, anticoagulant Eliquis, and cancer immunotherapy Opdivo, with an expected increase of up to two-thirds.Eli Lilly (#38): $44.7 billion revenue (+5%), $600 million in printing costs (0%). The company is a leader in liver, diabetes, and obesity drug development.In third-party health payment management, the best performers are expected to be Humana, ranked 92nd, and UnitedHealth Group, ranked 17th.

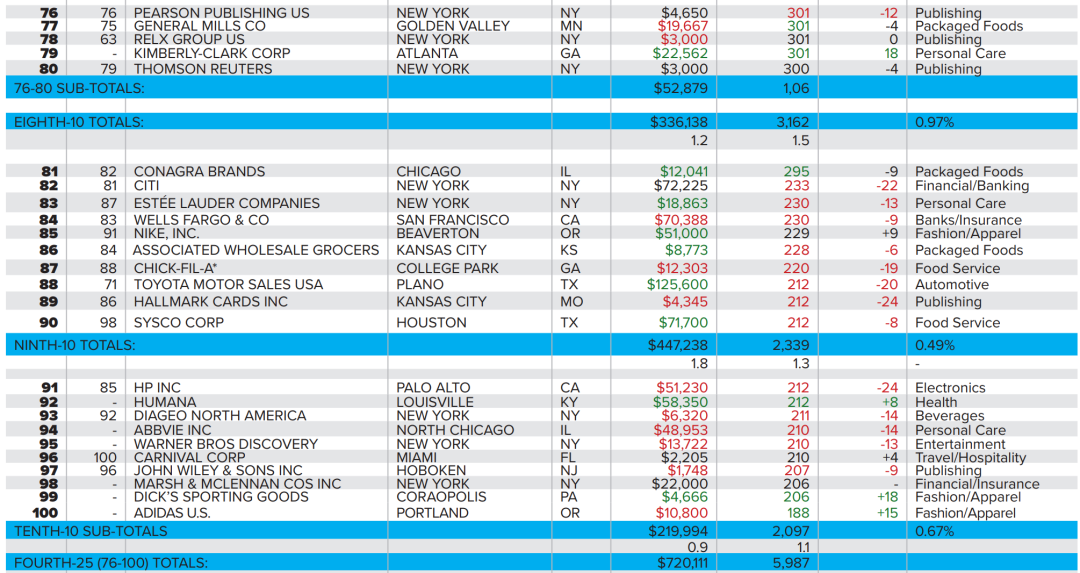

Discount Retail IndustryThe discount retail industry is dominated by four major demand companies, contributing 87.3% of the industry's print procurement volume. Ranked 8th, Walmart generated $630.5 billion in revenue (down 3%), with remaining printing expenses of $1 billion (down 11%). Like Kroger, ranked 23rd, Walmart has further promoted supplier engagement through an internal marketing agency. As an extension of its supplier center, Walmart includes promotions such as signage, financial services companies (FSI), and closed-circuit satellite broadcasts in buying and selling activities. Albertsons, ranked 44th, is also launching its own agency. Costco Wholesale, ranked 65th, had revenue of $284.2 billion (+16%) and printing expenses of $300 million (-51%), ranking low because most seasonal signage and in-store promotions are fully funded by suppliers. Costco's core focus is on retaining its 68 million members and gaining more annual subscription users through cards, checks, and mail, which is its only profit target. Although there was an attempt to discontinue the "Costco Connection" monthly magazine, it is still being published online and in print with eight regional editions, supported solely by cooperative advertising, and is not included in the above print expenditure calculation.The six discount retail companies on the list contributed $4.8 billion, accounting for 9% of the industry's total demand, exceeding 1/33 of the total print demand.Changes in the Logistics/Freight IndustryRanked 4th, the United States Postal Service (USPS) generated $85.1 billion in revenue (down 3%), with $1.4 billion in printing expenses (down 5%), showing the greatest ability to navigate economic imbalances by passing actual and projected costs on to all other companies. USPS is not only the largest buyer but also has the most buyers. Each postmaster can purchase up to $10,000 per item for local businesses and activities. Key decision points are concentrated in the customer marketing department.FedEx, ranked 13th, generated $108 billion in revenue (up 3%), with printing expenses under $1 billion (down 1%), and is a highly integrated participant in the logistics supply chain. Its FedEx offices have more than 2,200 locations, accounting for nearly half of all image-related products and services. Most procurement is decentralized by region and department, requiring potential suppliers to register on electronic portals, select North American Industry Classification System (NAICS) codes, and then wait a long time to receive a response or request for quotation.

United Parcel Service (UPS), ranked 39th, with revenue of $98.3 billion (up 2%) and $600 million pending, had 0% change. The "Big Brown" company's revenue, market share, media spending, and public reputation are all shrinking and declining, especially in the minds of franchise store owners and customers. The parent company's less-than-truckload (LTL) business has been sold, and the company is dangerously focused on small parcel delivery.Uline, ranked 18th, has revenue of $7.7 billion (up 22%) with $900 million pending (unchangeable). The Uihlein family founded Uline 45 years ago in a basement, and it has now become a major distributor of packaging supplies, largely thanks to its ubiquitous 800-page seasonal catalog, whose enormous size encourages recipients to keep, display, and purchase items.Other non-essential consumer goods

Ten long-established publishers dominate the industry, despite the entry (and exit) of thousands of 'small publishers.' Hearst Communications, ranked 30th, and RELX Group US, ranked 63rd, are typical representatives of magazine media.

In the non-essential consumer goods sector, the two largest publicly traded entertainment companies are: The Walt Disney Company, ranked 6th, and Warner Bros. Discovery, ranked 95th. In the fashion sector, Nike, ranked 85th, is experiencing rapid growth.

Five companies in the two durable goods sectors are expected to jointly boost demand for printed materials. 3M, ranked 21st, is the largest participant in the industry; Home Depot, ranked 35th, will drive the print business from three different directions to (re)create demand affected by the economic downturn.

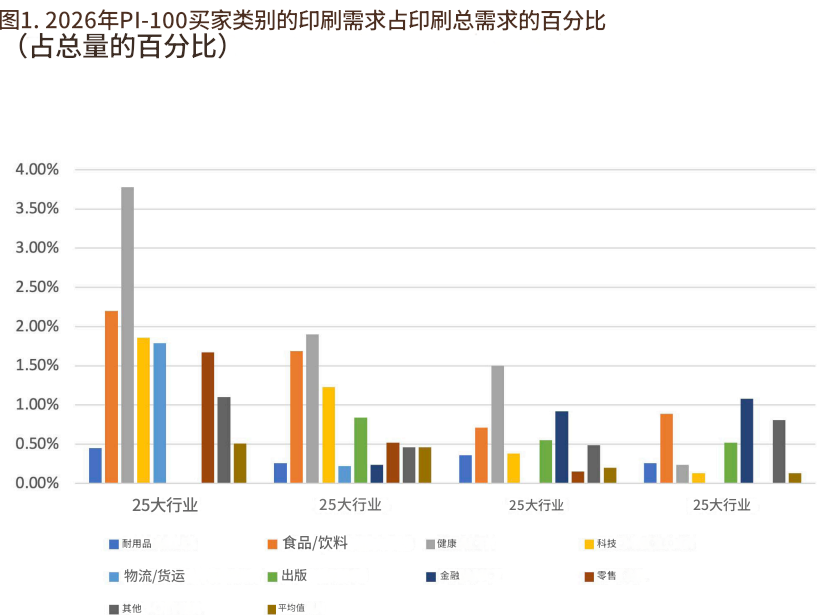

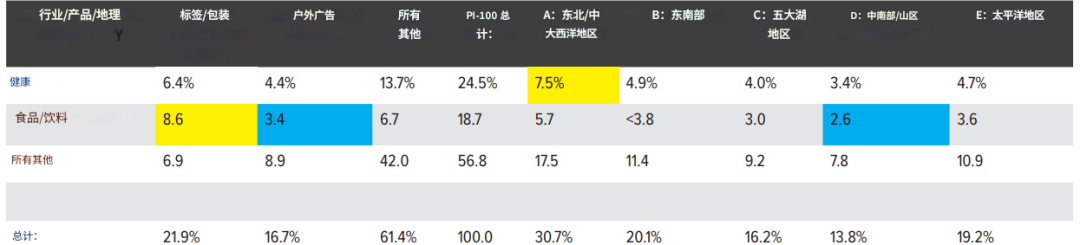

Printing Industry Roadmap and Investment StrategyAccording to the cross-tabulation analysis, the optimal combination is providing labeling/packaging services to healthcare suppliers in the U.S. Northeast/Mid-Atlantic region (8.6x7.5=64.5). In contrast, the least attractive combination in the cross-tabulation is offering outdoor advertising services to food and beverage companies in the Midwest/Mountain regions.

What can be confirmed is that printing companies and their suppliers must now treat industry data as a roadmap rather than a rearview mirror. In a printing economy dominated by packaging, food, health, and technology giants, relying on past assumptions about output and product mix risks obsolescence.Companies that invest cross-industry, narrow their focus, and invest strategically will survive. Those that insist on a broad, unfocused commoditized business will inevitably face consolidation and exit, as artificial intelligence, capital costs, and the evolving buyer hierarchy will permanently reshape the market landscape.