Merger and acquisition benefits explode! Amco's first-quarter revenue reaches 40.9 billion yuan, with net profit surging 88%!

Recently, global packaging giant Amcor announced its financial report for the first quarter of fiscal year 2026. This report is not only the first full-quarter performance presentation since its integration with the former Berry Global but also signals strong growth. The report shows that, thanks to the significant contributions from the acquisition and the remarkable release of synergies, Amcor's overall performance has seen a substantial leap. At the same time, the mixed performance in the end markets is also a trend worth the industry's attention.

整体业绩飙升:净销售额与利润双双暴涨

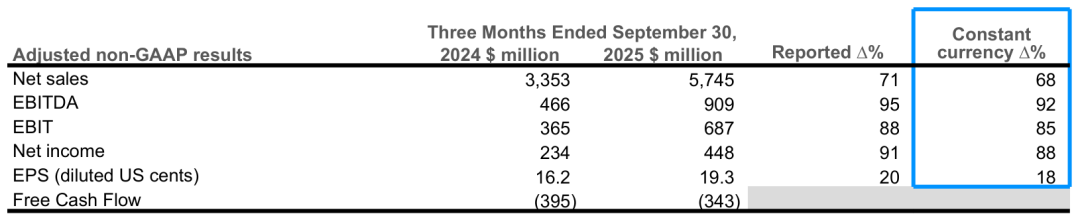

From an overall data perspective, Amcor's first-quarter performance was impressive: Net sales: On a constant currency basis, net sales reached $5.745 billion (approximately RMB 40.9 billion), representing a 68% year-on-year increase. Of this, about $2.4 billion of the growth came from acquisition sales after divested assets were excluded, reflecting a year-on-year increase of approximately 70%. However, net sales were negatively impacted by roughly 1% due to lower raw material costs. Adjusted EBITDA: On a constant currency basis, adjusted EBITDA was $687 million, soaring 85% year-on-year. Of this, acquisitions contributed about $295 million to EBITDA (after excluding divested assets), showing a year-on-year increase of around 81%. Net profit was approximately $448 million (about RMB 3.2 billion), up 88% year-on-year. Margin improvement: Adjusted EBITDA margin reached 12%, up 110 basis points from the same period last year, demonstrating a significant improvement in the quality of the combined business. Key drivers: Beyond the direct contributions from acquisitions, approximately $33 million in synergies, strict cost control, and improvements in production efficiency were the main drivers of profit growth. However, lower sales volume and unfavorable price/product mix partially offset earnings.

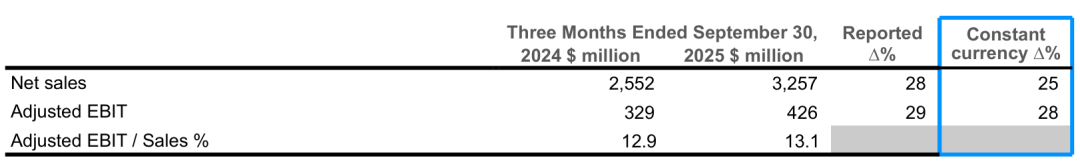

Performance of Two Major Business Segments: Significant Improvement in Hard Packaging Profit MarginsThis quarter, Amcor's two core business segments-Global Flexible Packaging Solutions and Global Rigid Packaging Solutions-each showed distinct performance highlights.Global Flexible Packaging Solutions segment

Net sales: Calculated at constant exchange rates, net sales were $3.257 billion, up 25% year over year. Sales from acquisitions (after deducting divested assets) contributed approximately $640 million, equivalent to about 25% growth; the increase in raw material costs brought about a favorable impact of approximately 1%.Sales volume: The company estimates that the segment's sales volume decreased by 2.8% compared to the combined sales of Amcor and Berry Global in the same period last year.North America and Europe: Sales in both regions declined. Categories such as healthcare and pet care showed resilient growth, but this was offset by declines in liquid, snack, confectionery, unprocessed films, and beauty and wellness categories.Emerging markets: Sales were flat compared to last year, with growth in the Asia-Pacific region offsetting declines in Latin America.Adjusted EBIT: $426 million, up 28% year over year at constant exchange rates. The growth was mainly driven by synergies, cost efficiencies, and improvements in production efficiency, partially offset by the decline in volume.Global Rigids Packaging Solutions segment.

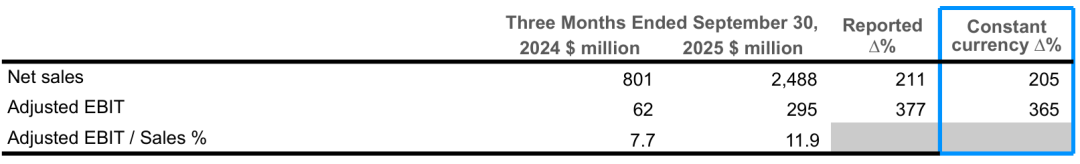

Net sales: Calculated at constant exchange rates, net sales reached $2.488 billion, up 205% from the previous year. Of this, approximately $1.7 billion of growth came from acquisition sales (after deducting divested assets), an increase of about 215%. The decline in raw material costs had an adverse impact of about 6%.Sales volume: Sales in this segment fell about 1% year-on-year (excluding non-core North American beverage business), remaining roughly flat compared with the previous fiscal quarter.North America: Sales volume was flat compared with the previous year. Categories such as pet care and specialty containers showed strong growth, but this was offset by declines in categories like beauty and wellness, food, and foodservice.Europe and Emerging Markets: Sales volume showed slight declines in both regions, with drops in emerging markets mainly concentrated in Latin America.Adjusted EBIT: $295 million, representing a surge of 365% at constant exchange rates.Impressive margin improvement: Adjusted EBIT margin reached 11.9%, up 420 basis points from the same period last year, reflecting a substantial enhancement in post-merger business quality.End markets and strategic outlook: divestment of non-core assets and outlookDuring the subsequent earnings call, Amcor CEO Peter Kleincke provided detailed explanations regarding end markets and company strategy.End market trends: Kleincke stated that the end market performance was "mixed." Key markets such as pet care performed strongly, but markets for meat and protein, foodservice, liquids, and beauty and wellness products were influenced by consumers' focus on cost-effectiveness.

M&A Synergy: In the first full quarter following the integration, AMCO achieved $38 million in synergies. The company reiterated that it expects pre-tax synergies related to the Berry acquisition to reach at least $260 million by the end of fiscal year 2026, and projects $650 million by the end of fiscal year 2028.Accelerated Asset Divestiture Process: AMCO is actively optimizing its asset portfolio. Konechni announced that the company has recently reached agreements to sell two businesses, with total proceeds of approximately $100 million. Outgoing CFO Michael Casamento revealed that one of them is a small plant in Europe with annual sales of less than $20 million, and the other is a joint venture. The company expects more non-core asset disposal actions in the current fiscal year.North American Beverage Business Review: AMCO is "advancing" evaluations of alternatives for its North American beverage business, including joint ventures or partnerships.Outlook: AMCO reaffirmed its financial outlook for fiscal year 2026, expecting free cash flow between $1.8 billion and $1.9 billion (after approximately $220 million in net cash integration and transaction costs), with capital expenditures expected between $850 million and $900 million. This outlook does not consider the potential impact of portfolio optimization measures.