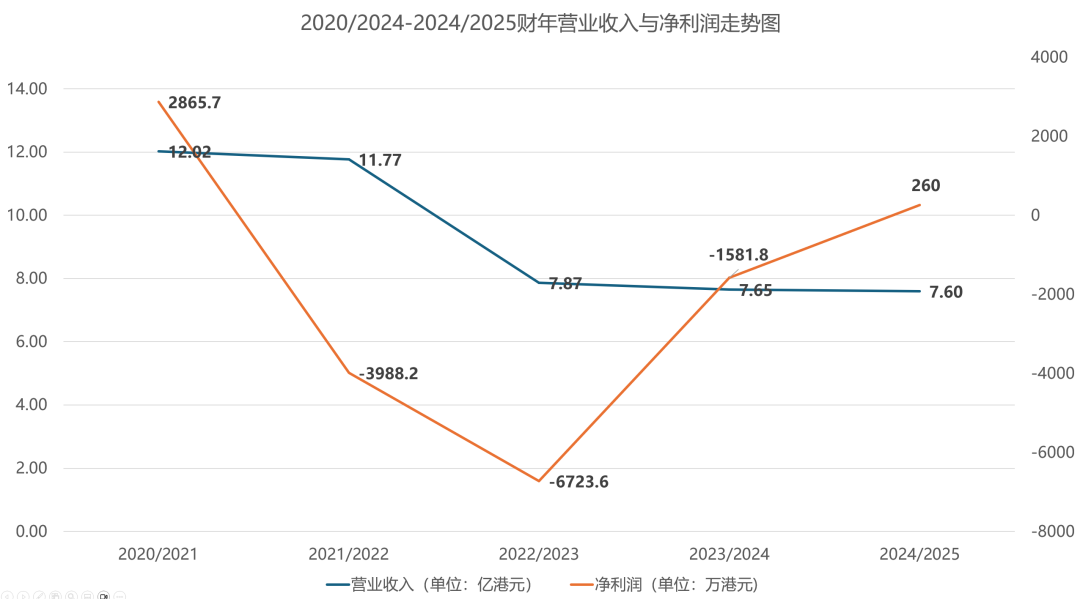

After losing money for three consecutive years, Jinsheng Group's net profit has turned positive. How can this cardboard packaging giant win the battle to turn things around?

Recently, Jinsheng Group (Holdings) Co., Ltd. released its annual performance report for the year ended March 31, 2025. This report showcases the company's impressive performance in turning losses into profits through actively adjusting strategies in a complex and ever-changing market environment, attracting industry attention. The report shows that despite the severe challenges faced by China's real estate and home appliance retail markets, as well as the uncertain global and domestic economic environment, Jinsheng Group still recorded a net profit of approximately HKD 2.6 million (approximately RMB 2.3713 million), which is a significant improvement in profitability compared to the net loss of approximately HKD 15.818 million (approximately RMB 14.4266 million) in the previous fiscal year.

It is worth noting that the company has been in a loss making state from the fiscal year 2021/2022 to the first half of the fiscal year 2024/2025. Among them, the revenue for the 2021/2022 fiscal year reached HKD 1.177 billion, but the net loss was as high as HKD 3898.2; In the fiscal year 2022/2023, the revenue significantly decreased to HKD 787 million, and the net loss further expanded to HKD 67.236 million; In the fiscal year 2023/2024, revenue continued to decline slightly to HKD 765 million, and net profit narrowed to HKD 15.818 million; The loss for the first half of the 2024/2025 fiscal year reached HKD 7.5 million.

Strategic transformation under market pressure: focusing on cardboard and semi-finished products

Jinsheng Group's main business is to produce high-quality corrugated cardboard and value-added structural design paper packaging products, which are mainly used in the field of home appliance packaging. Faced with the current sluggish real estate market and severe challenges in the home appliance retail market, as well as the uncertain global and domestic economic environment, customers' purchasing behavior is generally becoming cautious, resulting in a decrease in overall order frequency.

In response to this situation, Jinsheng Group has actively adjusted its business strategy to enhance operational efficiency and maintain a competitive advantage. The company will continue to focus its resources on the production and sales of cardboard and semi-finished products this year. Although the unit selling price of such products is usually lower than the traditional printing and corrugated paper packaging products of Jinsheng Group, this strategic shift has significantly improved overall sales and operational efficiency, successfully compensating for the impact of declining market demand.

In addition, Jinsheng Group has continued to focus on expanding its domestic market position and diversifying its customer base over the past year. This measure has brought more sales orders from domestic customers and pushed the company further into non retail fields such as medical product packaging. Therefore, even though the frequency of customer orders has decreased, the company has successfully maintained its overall sales level throughout the year.

However, this shift in sales mix has also led to a decrease in the average unit price of Jinsheng Group's products. Meanwhile, due to production line maintenance and integration activities, the company's production capacity has also been slightly affected. Despite this, with efforts to expand its sources of revenue, Jinsheng Group successfully maintained its revenue level this year, recording a revenue of approximately HKD 760.4 million (approximately RMB 694 million), a slight decrease of only about 0.5% from the previous fiscal year's revenue of approximately HKD 764.5 million (approximately RMB 697 million), and remained relatively stable.

At the same time, the company's gross profit and gross profit margin have also achieved slight improvements. This year's gross profit reached approximately HKD 142.1 million, with a gross profit margin of 18.7%, compared to approximately HKD 131.7 million and 17.2% in the previous fiscal year, respectively. This improvement is mainly attributed to the effective maintenance of operational efficiency by Jinsheng Group through a series of cost reduction and efficiency improvement measures, as well as the optimization and integration of production lines, significantly enhancing cost control capabilities. These efforts successfully offset the potential profit margin decline caused by the strategic adjustment of the sales mix (i.e. increasing the proportion of cardboard and semi-finished product production), demonstrating the company's effectiveness in refined management.

Faced with a challenging market environment, Jinsheng Group believes that these strategic adjustments are necessary to achieve sustainable development. By expanding its business scope and integrating production lines to improve cost-effectiveness, Jinsheng Group has laid a solid foundation for seizing future market opportunities and ensuring long-term sustainable growth.

Guangdong Business: Core Support and Optimization Integration

As the core business area of Jinsheng Group, the Guangdong factory still focuses on high value-added paper packaging business this year, including the production of high-quality corrugated cardboard and structural design paper packaging products. This part of the business continues to constitute the core source of revenue for Jinsheng Group.

Despite the continuous shift in customer preferences for supply chain locations, increasing cost pressures, and weak economic recovery, Jinsheng Group has successfully maintained sales by implementing strategic adjustments that meet market demand, including adjusting its sales product portfolio. Although the unit selling price of cardboard and semi-finished products is lower than that of structural packaging products, their sales costs are relatively low, which helps balance the overall profit margin. Therefore, Jinsheng Group's revenue from selling goods slightly decreased by about 1.2% from approximately HKD 758.2 million (approximately RMB 692 million) in the previous fiscal year to approximately HKD 748.8 million (approximately RMB 683 million) in this year, reflecting its resilience in core markets.

At the same time, Guangdong business, as the core business division of Jinsheng Group, continued to contribute the majority of the group's gross profit this year. To align with the strategic goal of maintaining revenue and market share of Jinsheng Group, the proportion of cardboard and semi-finished packaging products in the sales mix remains stable. Benefiting from the lower sales costs of these products, coupled with strict cost control and the integration of production lines in the Dongguan factory, Jinsheng Group successfully maintained its gross profit level throughout the year. The gross profit of the Guangdong business increased to approximately HKD 131.6 million (compared to approximately HKD 125.7 million in the previous fiscal year), and the gross profit margin improved to approximately 17.6% (compared to approximately 16.6% in the previous fiscal year), once again confirming the profitability of its core region.

Future outlook: The path of green packaging that combines opportunities and challenges

Looking ahead, Jinsheng Group remains committed to continuously improving internal controls and utilizing its integrated regional operations and production lines to further enhance profitability. With the gradual recovery of e-commerce demand, the demand for corrugated packaging has also improved, bringing positive signals to the industry.

Looking ahead to the fiscal year 2025/2026, Jinsheng Group will face a business environment that combines opportunities and challenges. The company believes that with the Chinese government actively promoting policies such as stabilizing the economy, expanding domestic demand, and promoting consumption, the stable recovery of the economy and the improvement of consumer confidence are expected to drive the growth of China's paper packaging industry. More importantly, corrugated paper, as a renewable and environmentally friendly packaging material, coincides with the current global promotion of green packaging principles, which makes Jinsheng Group cautiously optimistic about the long-term prospects of the industry.

The widespread application of corrugated paper packaging is not only driven by the demand of traditional industries, but also by the development of non retail industries such as medical supplies, which will further expand its market space. In order to meet customer needs and expand customer base, Jinsheng Group has strengthened production and sales balance through resource integration in recent years, ensuring flexible combination and stable supply of domestic and foreign raw materials.

Faced with changes in customer demand and global supply chain transfer trends, Jinsheng Group will continue to develop a comprehensive strategy, planning to seize the opportunities arising from the supply chain transfer to Southeast Asia through its affiliated companies and actively attract new customers. Meanwhile, Jinsheng Group will actively seek potential strategic cooperation opportunities to expand its market share both domestically and internationally.

Under the influence of global inflationary pressures and geopolitical tensions, the business environment is becoming increasingly uncertain. Jinsheng Group will leverage its long-term partnerships with existing suppliers and implement a diversified procurement strategy, including purchasing domestic and imported raw materials, to cope with market fluctuations, ensure quality standards, and maintain stable raw material supply.

Despite the challenges facing the global business environment, the rapid growth of China's e-commerce industry and the increasing demand for high-quality and environmentally friendly packaging are expected to bring significant growth opportunities to the Chinese paper packaging industry. However, these opportunities will also intensify market competition and raise requirements for environmental protection and industry standards. To meet the constantly changing market demands, Jinsheng Group will continue to integrate resources and production capabilities, investing more resources in the production of cardboard and semi-finished packaging products to enhance operational efficiency and flexibility.

Jinsheng Group will continue to review its business operations and maintain innovation in business development and strategy. In addition to comprehensive cost control and efficiency improvement measures, as well as adhering to prudent business and financial strategies, Jinsheng Group is also committed to ensuring safe and environmentally friendly production. The company will utilize advanced production technology to ensure that its high-quality products meet market demand, support sustainable development, and achieve strong profitability, thereby further consolidating its leading position in China's corrugated paper packaging industry.